Page 14 - Chap1 Charge of Tax & Concept of Supply

P. 14

The location of supplier is in Bangalore (Karnataka) and the place of supply for the items

contained in the truck is Tamil Nadu in terms of section 10(1)(a) of the IGST Act, 2017. Therefore, the

given supply of items is an inter-State supply as the location of supplier and place of supply are in two different

States [Section 7 of IGST Act, 2017]. Thus, it is liable to IGST.

2) As per section 25(4) of CGST Act, 2017, a person who has obtained more than one registration in one or

more State or Union territory shall be treated as 'distinct persons' for each such registration.

As per para 2 of Schedule I to CGST Act, 2017, supply of goods and/or services between 'distinct

persons' in the course or furtherance of business is treated as supply under GST, even when made without

consideration.

As per CBIC clarification, inter-State movement of various modes of conveyance between 'distinct

persons' as specified in section 25(4), not involving further supply of such conveyance, including trucks carrying

goods &/or passengers; or for repairs and maintenance, may be treated 'neither as a supply of goods nor supply

of service' and therefore, will not be leviable to IGST. However, applicable CGST/SGST/IGST shall be

leviable on repairs and maintenance done for such conveyance.

3. With reference to the above provision pertaining to distinct person in this case, stand-alone machine and container

truck are moved to client location and not between 'distinct persons'. Hence, the same will fall outside the

scope of supply and will not be leviable to GST.

4. 'Works contract' means a contract for repair, maintenance of any immovable property wherein transfer of

property in goods is involved in the execution of such contract.

In this case, the supplier provides maintenance and repair services for power plants that are in the

nature of immovable property and uses consumables and parts for the repairs. Hence, the contract is that of a

works contract which is a 'composite supply'. The composite supply of works contract is classified as supply

of service in terms of para 6(a) of Schedule II to the CGST Act, 2017.

The value of the items actually used in the repairs will be included in the invoice raised for the

service and will be charged to tax at that point of time.

5. As per section 8 of CGST Act, 2017, a composite supply is treated as a supply of the principal supply involved

therein and charged to tax accordingly. The activity is a composite supply of works contract, which is treated as

supply of service.

6. In the given case the location of the supplier is in Bangalore (Karnataka); and the place of supply of works

contract services is Tamil Nadu in terms of section 12(3) of IGST Act, 2017.

Therefore, the given supply is an inter-State supply as the location of the supplier and the place of

supply are in two different States [Section 7 of IGST Act, 2017]. Thus, supply will be leviable to IGST.

7. In given case, the location of the supplier and the place of supply of works contract services are within the same

State. Therefore, the given supply is an intra- State supply in terms of section 8 of IGST Act, 2017 and thus,

chargeable to CGST and SGST.

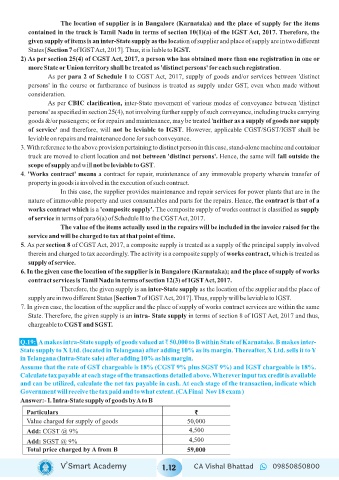

Q.19: A makes intra-State supply of goods valued at ` 50,000 to B within State of Karnatake. B makes inter-

State supply to X Ltd. (located in Telangana) after adding 10% as its margin. Thereafter, X Ltd. sells it to Y

in Telangana (Intra-State sale) after adding 10% as his margin.

Assume that the rate of GST chargeable is 18% (CGST 9% plus SGST 9%) and IGST chargeable is 18%.

Calculate tax payable at each stage of the transactions detailed above. Wherever input tax credit is available

and can be utilized, calculate the net tax payable in cash. At each stage of the transaction, indicate which

Government will receive the tax paid and to what extent.(CA Final Nov 18 exam )

Answer:- I. Intra-State supply of goods by A to B

Particulars ₹

Value charged for supply of goods 50,000

Add: CGST @ 9% 4,500

Add: SGST @ 9% 4,500

Total price charged by A from B 59,000

V’Smart Academy 1.12 CA Vishal Bhattad 09850850800