Page 16 - Chapter 5 TOS

P. 16

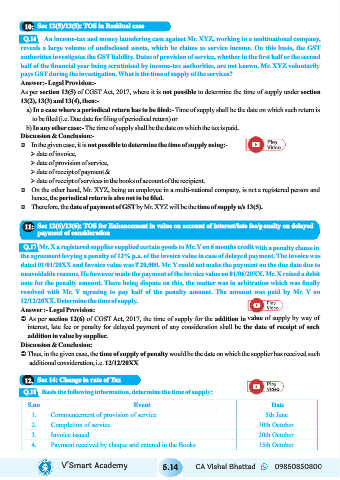

10: Sec 12(5)/13(5): TOS in Residual case

Q.16

An income-tax and money laundering case against Mr. XYZ, working in a multinational company,

reveals a large volume of undisclosed assets, which he claims as service income. On this basis, the GST

authorities investigates the GST liability. Dates of provision of service, whether in the first half or the second

half of the financial year being scrutinised by income-tax authorities, are not known. Mr. XYZ voluntarily

pays GST during the investigation. What is the time of supply of the services?

Answer:- Legal Provision:-

As per section 13(5) of CGST Act, 2017, where it is not possible to determine the time of supply under section

13(2), 13(3) and 13(4), then:-

a) In a case where a periodical return has to be filed:- Time of supply shall be the date on which such return is

to be filed (i.e. Due date for filing of periodical return) or

b) In any other case:- The time of supply shall be the date on which the tax is paid.

Discussion & Conclusion:-

Ü In the given case, it is not possible to determine the time of supply using:-

Ø date of invoice,

Ø date of provision of service,

Ø date of receipt of payment &

Ø date of receipt of services in the books of account of the recipient.

Ü On the other hand, Mr. XYZ, being an employee in a multi-national company, is not a registered person and

hence, the periodical return is also not to be filed.

Ü Therefore, the date of payment of GST by Mr. XYZ will be the time of supply u/s 13(5).

11: Sec 12(6)/13(6): TOS for Enhancement in value on account of interest/late fee/penalty on delayed

payment of consideration

Q.17 Mr. X a registered supplier supplied certain goods to Mr. Y on 6 months credit with a penalty clause in

the agreement levying a penalty of 12% p.a. of the invoice value in case of delayed payment. The invoice was

dated 01/01/20XX and Invoice value was ₹ 20,000. Mr. Y could not make the payment on the due date due to

unavoidable reasons. He however made the payment of the invoice value on 01/06/20XX. Mr. X raised a debit

note for the penalty amount. There being dispute on this, the matter was in arbitration which was finally

resolved with Mr. Y agreeing to pay half of the penalty amount. The amount was paid by Mr. Y on

12/12/20XX. Determine the time of supply.

Answer :- Legal Provision:

Ü As per section 12(6) of CGST Act, 2017, the time of supply for the addition in value of supply by way of

interest, late fee or penalty for delayed payment of any consideration shall be the date of receipt of such

addition in value by supplier.

Discussion & Conclusion:

Ü Thus, in the given case, the time of supply of penalty would be the date on which the supplier has received such

additional consideration, i.e. 12/12/20XX

12. Sec 14: Change in rate of Tax

Q.18

Basis the following information, determine the time of supply:

S.no Event Date

1. Commencement of provision of service 5th June

2. Completion of service 10th October

3. Invoice issued 20th October

4. Payment received by cheque and entered in the Books 15th October

V’Smart Academy 5.14 CA Vishal Bhattad 09850850800