Page 29 - Ch_10 ITC

P. 29

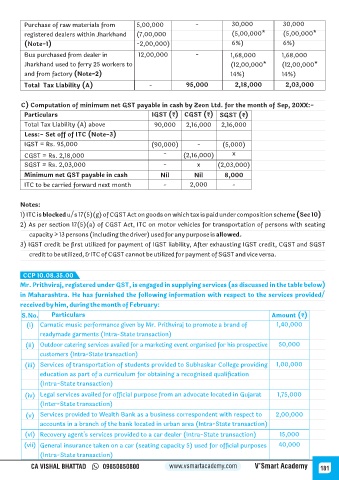

Purchase of raw materials from 5,00,000 - 30,000 30,000

registered dealers within Jharkhand (7,00,000 (5,00,000* (5,00,000*

(Note-1) -2,00,000) 6%) 6%)

Bus purchased from dealer in 12,00,000 - 1,68,000 1,68,000

Jharkhand used to ferry 25 workers to (12,00,000* (12,00,000*

and from factory (Note-2) 14%) 14%)

Total Tax Liability (A) - 95,000 2,18,000 2,03,000

C) Computation of minimum net GST payable in cash by Zeon Ltd. for the month of Sep, 20XX:-

Particulars IGST (₹) CGST (₹) SGST (₹)

Total Tax Liability (A) above 90,000 2,16,000 2,16,000

Less:- Set off of ITC (Note-3)

IGST = Rs. 95,000 (90,000) - (5,000)

CGST = Rs. 2,18,000 - (2,16,000) x

SGST = Rs. 2,03,000 - x (2,03,000)

Minimum net GST payable in cash Nil Nil 8,000

ITC to be carried forward next month - 2,000 -

Notes:

1) ITC is blocked u/s 17(5)(g) of CGST Act on goods on which tax is paid under composition scheme (Sec 10)

2) As per section 17(5)(a) of CGST Act, ITC on motor vehicles for transportation of persons with seating

capacity > 13 persons (including the driver) used for any purpose is allowed.

3) IGST credit be first utilized for payment of IGST liability, After exhausting IGST credit, CGST and SGST

credit to be utilized, & ITC of CGST cannot be utilized for payment of SGST and vice versa.

CCP 10.08.35.00

Mr. Prithviraj, registered under GST, is engaged in supplying services (as discussed in the table below)

in Maharashtra. He has furnished the following information with respect to the services provided/

received by him, during the month of February:

S.No. Particulars Amount (₹)

(i) Carnatic music performance given by Mr. Prithviraj to promote a brand of 1,40,000

readymade garments (Intra-State transaction)

(ii) Outdoor catering services availed for a marketing event organised for his prospective 50,000

customers (Intra-State transaction)

(iii) Services of transportation of students provided to Subhaskar College providing 1,00,000

education as part of a curriculum for obtaining a recognised qualification

(Intra-State transaction)

(iv) Legal services availed for official purpose from an advocate located in Gujarat 1,75,000

(Inter-State transaction)

(v) Services provided to Wealth Bank as a business correspondent with respect to 2,00,000

accounts in a branch of the bank located in urban area (Intra-State transaction)

(vi) Recovery agent's services provided to a car dealer (Intra-State transaction) 15,000

(vii) General insurance taken on a car (seating capacity 5) used for official purposes 40,000

(Intra-State transaction)

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 181