Page 15 - Ch3_RCM

P. 15

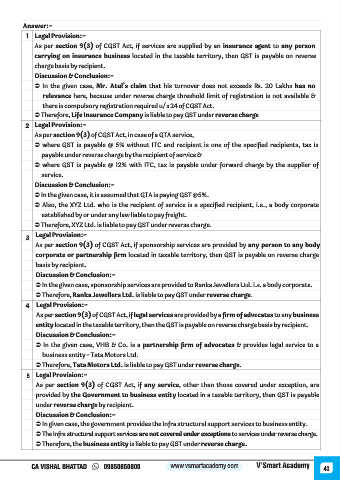

Answer:-

1 Legal Provision:-

As per section 9(3) of CGST Act, if services are supplied by an insurance agent to any person

carrying on insurance business located in the taxable territory, then GST is payable on reverse

charge basis by recipient.

Discussion & Conclusion:-

Ü In the given case, Mr. Atul's claim that his turnover does not exceeds Rs. 20 Lakhs has no

relevance here, because under reverse charge threshold limit of registration is not available &

there is compulsory registration required u/s 24 of CGST Act.

Ü Therefore, Life Insurance Company is liable to pay GST under reverse charge

2 Legal Provision:-

As per section 9(3) of CGST Act, in case of a GTA service,

Ü where GST is payable @ 5% without ITC and recipient is one of the specified recipients, tax is

payable under reverse charge by the recipient of service &

Ü where GST is payable @ 12% with ITC, tax is payable under forward charge by the supplier of

service.

Discussion & Conclusion:-

Ü In the given case, it is assumed that GTA is paying GST @5%.

Ü Also, the XYZ Ltd. who is the recipient of service is a specified recipient, i.e., a body corporate

established by or under any law liable to pay freight.

Ü Therefore, XYZ Ltd. is liable to pay GST under reverse charge.

Legal Provision:-

3

As per section 9(3) of CGST Act, if sponsorship services are provided by any person to any body

corporate or partnership firm located in taxable territory, then GST is payable on reverse charge

basis by recipient.

Discussion & Conclusion:-

Ü In the given case, sponsorship services are provided to Ranka Jewellers Ltd. i.e. a body corporate.

Ü Therefore, Ranka Jewellers Ltd. is liable to pay GST under reverse charge.

4 Legal Provision:-

As per section 9(3) of CGST Act, if legal services are provided by a firm of advocates to any business

entity located in the taxable territory, then the GST is payable on reverse charge basis by recipient.

Discussion & Conclusion:-

Ü In the given case, VHB & Co. is a partnership firm of advocates & provides legal service to a

business entity - Tata Motors Ltd.

Ü Therefore, Tata Motors Ltd. is liable to pay GST under reverse charge.

5 Legal Provision:-

As per section 9(3) of CGST Act, if any service, other than those covered under exception, are

provided by the Government to business entity located in a taxable territory, then GST is payable

under reverse charge by recipient.

Discussion & Conclusion:-

Ü In given case, the government provides the Infra structural support services to business entity.

Ü The Infra structural support services are not covered under exceptions to services under reverse charge.

Ü Therefore, the business entity is liable to pay GST under reverse charge.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 43