Page 189 - CA Inter MCQ Book

P. 189

CA RAVI TAORI CA INTER AUDIT MCQs

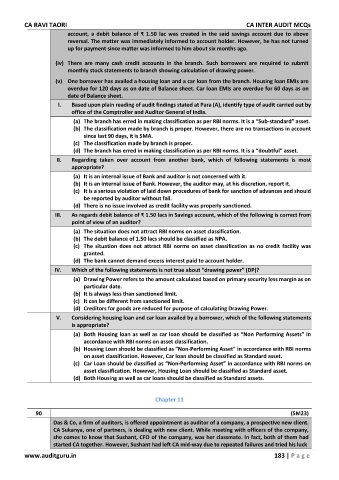

account, a debit balance of ₹ 1.50 lac was created in the said savings account due to above

reversal. The matter was immediately informed to account holder. However, he has not turned

up for payment since matter was informed to him about six months ago.

(iv) There are many cash credit accounts in the branch. Such borrowers are required to submit

monthly stock statements to branch showing calculation of drawing power.

(v) One borrower has availed a housing loan and a car loan from the branch. Housing loan EMIs are

overdue for 120 days as on date of Balance sheet. Car loan EMIs are overdue for 60 days as on

date of Balance sheet.

I. Based upon plain reading of audit findings stated at Para (A), identify type of audit carried out by

office of the Comptroller and Auditor General of India.

(a) The branch has erred in making classification as per RBI norms. It is a “Sub-standard” asset.

(b) The classification made by branch is proper. However, there are no transactions in account

since last 90 days, it is SMA.

(c) The classification made by branch is proper.

(d) The branch has erred in making classification as per RBI norms. It is a “doubtful” asset.

II. Regarding taken over account from another bank, which of following statements is most

appropriate?

(a) It is an internal issue of Bank and auditor is not concerned with it.

(b) It is an internal issue of Bank. However, the auditor may, at his discretion, report it.

(c) It is a serious violation of laid down procedures of bank for sanction of advances and should

be reported by auditor without fail.

(d) There is no issue involved as credit facility was properly sanctioned.

III. As regards debit balance of ₹ 1.50 lacs in Savings account, which of the following is correct from

point of view of an auditor?

(a) The situation does not attract RBI norms on asset classification.

(b) The debit balance of 1.50 lacs should be classified as NPA.

(c) The situation does not attract RBI norms on asset classification as no credit facility was

granted.

(d) The bank cannot demand excess interest paid to account holder.

IV. Which of the following statements is not true about “drawing power” (DP)?

(a) Drawing Power refers to the amount calculated based on primary security less margin as on

particular date.

(b) It is always less than sanctioned limit.

(c) It can be different from sanctioned limit.

(d) Creditors for goods are reduced for purpose of calculating Drawing Power.

V. Considering housing loan and car loan availed by a borrower, which of the following statements

is appropriate?

(a) Both Housing loan as well as car loan should be classified as “Non Performing Assets” in

accordance with RBI norms on asset classification.

(b) Housing Loan should be classified as “Non-Performing Asset” in accordance with RBI norms

on asset classification. However, Car loan should be classified as Standard asset.

(c) Car Loan should be classified as “Non-Performing Asset” in accordance with RBI norms on

asset classification. However, Housing Loan should be classified as Standard asset.

(d) Both Housing as well as car loans should be classified as Standard assets.

Chapter 11

90 (SM23)

Das & Co, a firm of auditors, is offered appointment as auditor of a company, a prospective new client.

CA Sukanya, one of partners, is dealing with new client. While meeting with officers of the company,

she comes to know that Sushant, CFO of the company, was her classmate. In fact, both of them had

started CA together. However, Sushant had left CA mid-way due to repeated failures and tried his luck

www.auditguru.in 183 | P a g e