Page 97 - CA Inter MCQ Book

P. 97

CA RAVI TAORI CA INTER AUDIT MCQs

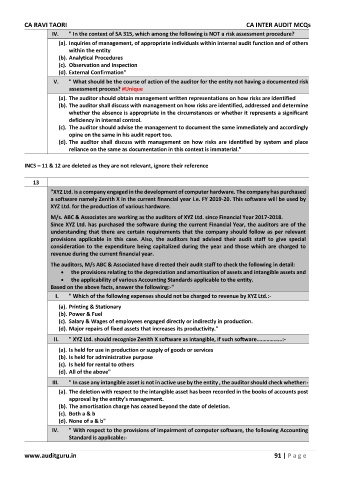

IV. " In the context of SA 315, which among the following is NOT a risk assessment procedure?

(a). Inquiries of management, of appropriate individuals within internal audit function and of others

within the entity

(b). Analytical Procedures

(c). Observation and Inspection

(d). External Confirmation"

V. " What should be the course of action of the auditor for the entity not having a documented risk

assessment process? #Unique

(a). The auditor should obtain management written representations on how risks are identified

(b). The auditor shall discuss with management on how risks are identified, addressed and determine

whether the absence is appropriate in the circumstances or whether it represents a significant

deficiency in internal control.

(c). The auditor should advise the management to document the same immediately and accordingly

opine on the same in his audit report too.

(d). The auditor shall discuss with management on how risks are identified by system and place

reliance on the same as documentation in this context is immaterial."

INCS – 11 & 12 are deleted as they are not relevant, ignore their reference

13

"XYZ Ltd. is a company engaged in the development of computer hardware. The company has purchased

a software namely Zenith X in the current financial year i.e. FY 2019-20. This software will be used by

XYZ Ltd. for the production of various hardware.

M/s. ABC & Associates are working as the auditors of XYZ Ltd. since Financial Year 2017-2018.

Since XYZ Ltd. has purchased the software during the current Financial Year, the auditors are of the

understanding that there are certain requirements that the company should follow as per relevant

provisions applicable in this case. Also, the auditors had advised their audit staff to give special

consideration to the expenditure being capitalized during the year and those which are charged to

revenue during the current financial year.

The auditors, M/s ABC & Associated have directed their audit staff to check the following in detail:

• the provisions relating to the depreciation and amortisation of assets and intangible assets and

• the applicability of various Accounting Standards applicable to the entity.

Based on the above facts, answer the following:-"

I. " Which of the following expenses should not be charged to revenue by XYZ Ltd.:-

(a). Printing & Stationary

(b). Power & Fuel

(c). Salary & Wages of employees engaged directly or indirectly in production.

(d). Major repairs of fixed assets that increases its productivity."

II. " XYZ Ltd. should recognize Zenith X software as intangible, if such software………………:-

(a). Is held for use in production or supply of goods or services

(b). Is held for administrative purpose

(c). Is held for rental to others

(d). All of the above"

III. " In case any intangible asset is not in active use by the entity , the auditor should check whether:-

(a). The deletion with respect to the intangible asset has been recorded in the books of accounts post

approval by the entity’s management.

(b). The amortisation charge has ceased beyond the date of deletion.

(c). Both a & b

(d). None of a & b"

IV. " With respect to the provisions of impairment of computer software, the following Accounting

Standard is applicable:-

www.auditguru.in 91 | P a g e