Page 8 - Chap7 ITC

P. 8

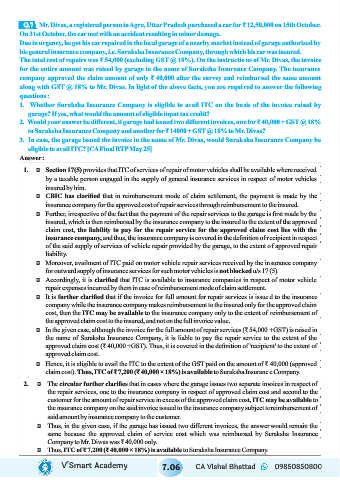

Q.7

Mr. Divas, a registered person in Agra, Uttar Pradesh purchased a car for ₹ 12,50,000 on 15th October.

On 31st October, the car met with an accident resulting in minor damage.

Due to urgency, he got his car repaired in the local garage of a nearby market instead of garage authorized by

his general insurance company, i.e. Suraksha Insurance Company, through which his car was insured.

The total cost of repairs was ₹ 54,000 (excluding GST @ 18%). On the instructions of Mr. Divas, the invoice

for the entire amount was raised by garage in the name of Suraksha Insurance Company. The insurance

company approved the claim amount of only ₹ 40,000 after the survey and reimbursed the same amount

along with GST @ 18% to Mr. Divas. In light of the above facts, you are required to answer the following

questions :

1. Whether Suraksha Insurance Company is eligible to avail ITC on the basis of the invoice raised by

garage? If yes, what would the amount of eligible input tax credit?

2. Would your answer be different, if garage had issued two different invoices, one for ₹ 40,000 + GST @ 18%

to Suraksha Insurance Company and another for ₹ 14000 + GST @ 18% to Mr. Divas?

3. In case, the garage issued the invoice in the name of Mr. Divas, would Suraksha Insurance Company be

eligible to avail ITC? [CA Final RTP May 25]

Answer :

1. Ü Section 17(5) provides that ITC of services of repair of motor vehicles shall be available where received

by a taxable person engaged in the supply of general insurance services in respect of motor vehicles

insured by him.

Ü CBIC has clarified that in reimbursement mode of claim settlement, the payment is made by the

insurance company for the approved cost of repair services through reimbursement to the insured.

Ü Further, irrespective of the fact that the payment of the repair services to the garage is first made by the

insured, which is then reimbursed by the insurance company to the insured to the extent of the approved

claim cost, the liability to pay for the repair service for the approved claim cost lies with the

insurance company, and thus, the insurance company is covered in the definition of recipient in respect

of the said supply of services of vehicle repair provided by the garage, to the extent of approved repair

liability.

Ü Moreover, availment of ITC paid on motor vehicle repair services received by the insurance company

for outward supply of insurance services for such motor vehicles is not blocked u/s 17(5).

Ü Accordingly, it is clarified that ITC is available to insurance companies in respect of motor vehicle

repair expenses incurred by them in case of reimbursement mode of claim settlement.

Ü It is further clarified that if the invoice for full amount for repair services is issued to the insurance

company while the insurance company makes reimbursement to the insured only for the approved claim

cost, then the ITC may be available to the insurance company only to the extent of reimbursement of

the approved claim cost to the insured, and not on the full invoice value.

Ü In the given case, although the invoice for the full amount of repair services (₹ 54,000 +GST) is raised in

the name of Suraksha Insurance Company, it is liable to pay the repair service to the extent of the

approved claim cost (₹ 40,000 +GST). Thus, it is covered in the definition of 'recipient' to the extent of

approved claim cost.

Ü Hence, it is eligible to avail the ITC to the extent of the GST paid on the amount of ₹ 40,000 (approved

claim cost). Thus, ITC of ₹ 7,200 (₹ 40,000 × 18%) is available to Suraksha Insurance Company.

2. Ü The circular further clarifies that in cases where the garage issues two separate invoices in respect of

the repair services, one to the insurance company in respect of approved claim cost and second to the

customer for the amount of repair service in excess of the approved claim cost, ITC may be available to

the insurance company on the said invoice issued to the insurance company subject to reimbursement of

said amount by insurance company to the customer.

Ü Thus, in the given case, if the garage has issued two different invoices, the answer would remain the

same because the approved claim of service cost which was reimbursed by Suraksha Insurance

Company to Mr. Diwas was ₹ 40,000 only.

Ü Thus, ITC of ₹ 7,200 (₹ 40,000 × 18%) is available to Suraksha Insurance Company.

V’Smart Academy 7.06 CA Vishal Bhattad 09850850800