Page 19 - Ch15_Computation of GST

P. 19

(iv) Intra - State inward supply of various services for use in the course or furtherance of business 6,50,000

(30 invoices)

Additional Information:

a) All the amounts given above are exclusive of taxes.

b) During the course of arranging and filing documents, the accountant of Ajay Limited observed that

an invoice for ₹ 30,000 (excluding tax) dated 02.12.20XX was omitted to be recorded in the books of

accounts and no payment was made against the same till the end of January 20YY. This invoice was

issued by Mr. Mukesh of Patna, from whom Ajay Limited had taken cars on rental basis. Invoice

included cost of fuel also. (Intra -State transaction).

c) Rate of GST applicable on various supplies are as follows:

Nature of supply CGST SGST IGST

Car rental service 2.5% 2.5% 5%

All other inward and outward supplies 9% 9% 18%

d) No opening balance of input tax credit exists in the beginning of the month.

e) Out of the 30 invoices of inward supply received, 6 invoices with taxable value amounting to ₹

1,50,000 were e-invoices in which Invoice Reference Number (IRN) was not mentioned. However,

all the invoices were duly reflected in GSTR 2B for the month of January 20YY, since the suppliers

had filed their GSTR-1.

f) Subject to the information given above, conditions necessary for claiming ITC were complied with.

You are required to calculate the amount of net GST liability payable in cash by Ajay

Limited for the month of January 20YY. Brief notes for treatment given for each item should form

part of your answer. [CA Inter Nov 22 Exam]

Answer:

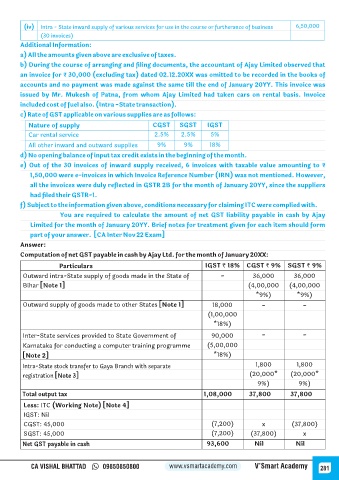

Computation of net GST payable in cash by Ajay Ltd. for the month of January 20XX:

Particulars IGST ` 18% CGST ` 9% SGST ` 9%

Outward intra-State supply of goods made in the State of - 36,000 36,000

Bihar [Note 1] (4,00,000 (4,00,000

*9%) *9%)

Outward supply of goods made to other States [Note 1] 18,000 - -

(1,00,000

*18%)

Inter-State services provided to State Government of 90,000 - -

Karnataka for conducting a computer training programme (5,00,000

[Note 2] *18%)

Intra-State stock transfer to Gaya Branch with separate 1,800 1,800

registration [Note 3] (20,000* (20,000*

9%) 9%)

Total output tax 1,08,000 37,800 37,800

Less: ITC (Working Note) [Note 4]

IGST: Nil

CGST: 45,000 (7,200) x (37,800)

SGST: 45,000 (7,200) (37,800) x

Net GST payable in cash 93,600 Nil Nil

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 281