Page 192 - CA Inter Audit PARAM

P. 192

CA Ravi Taori

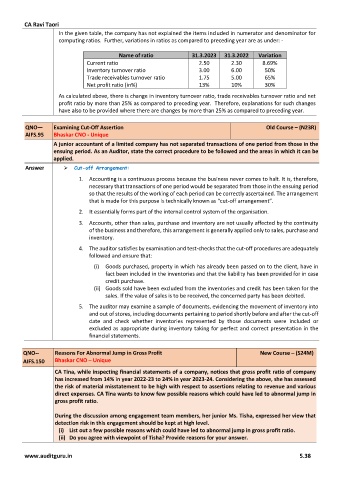

In the given table, the company has not explained the items included in numerator and denominator for

computing ratios. Further, variations in ratios as compared to preceding year are as under: -

Name of ratio 31.3.2023 31.3.2022 Variation

Current ratio 2.50 2.30 8.69%

Inventory turnover ratio 3.00 6.00 50%

Trade receivables turnover ratio 1.75 5.00 65%

Net profit ratio (in%) 13% 10% 30%

As calculated above, there is change in inventory turnover ratio, trade receivables turnover ratio and net

profit ratio by more than 25% as compared to preceding year. Therefore, explanations for such changes

have also to be provided where there are changes by more than 25% as compared to preceding year.

QNO— Examining Cut-Off Assertion Old Course – (N23R)

AIFS.95 Bhaskar CNO - Unique

A junior accountant of a limited company has not separated transactions of one period from those in the

ensuing period. As an Auditor, state the correct procedure to be followed and the areas in which it can be

applied.

Answer ➢ Cut-off Arrangement:

1. Accounting is a continuous process because the business never comes to halt. It is, therefore,

necessary that transactions of one period would be separated from those in the ensuing period

so that the results of the working of each period can be correctly ascertained. The arrangement

that is made for this purpose is technically known as “cut-off arrangement”.

2. It essentially forms part of the internal control system of the organisation.

3. Accounts, other than sales, purchase and inventory are not usually affected by the continuity

of the business and therefore, this arrangement is generally applied only to sales, purchase and

inventory.

4. The auditor satisfies by examination and test-checks that the cut-off procedures are adequately

followed and ensure that:

(i) Goods purchased, property in which has already been passed on to the client, have in

fact been included in the inventories and that the liability has been provided for in case

credit purchase.

(ii) Goods sold have been excluded from the inventories and credit has been taken for the

sales. If the value of sales is to be received, the concerned party has been debited.

5. The auditor may examine a sample of documents, evidencing the movement of inventory into

and out of stores, including documents pertaining to period shortly before and after the cut-off

date and check whether inventories represented by those documents were included or

excluded as appropriate during inventory taking for perfect and correct presentation in the

financial statements.

QNO-- Reasons For Abnormal Jump in Gross Profit New Course – (S24M)

AIFS.150 Bhaskar CNO – Unique

CA Tina, while inspecting financial statements of a company, notices that gross profit ratio of company

has increased from 14% in year 2022-23 to 24% in year 2023-24. Considering the above, she has assessed

the risk of material misstatement to be high with respect to assertions relating to revenue and various

direct expenses. CA Tina wants to know few possible reasons which could have led to abnormal jump in

gross profit ratio.

During the discussion among engagement team members, her junior Ms. Tisha, expressed her view that

detection risk in this engagement should be kept at high level.

(i) List out a few possible reasons which could have led to abnormal jump in gross profit ratio.

(ii) Do you agree with viewpoint of Tisha? Provide reasons for your answer.

www.auditguru.in 5.38