Page 255 - CA Inter Audit PARAM

P. 255

CA Ravi Taori

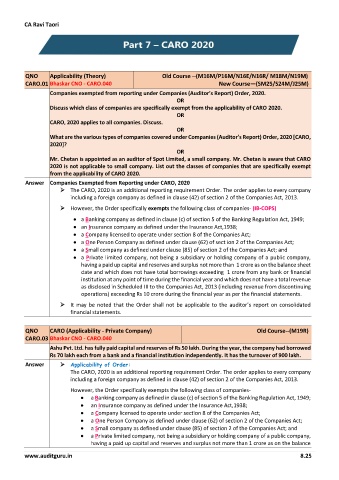

QNO Applicability (Theory) Old Course --(M16M/P16M/N16E/N16R/ M18M/N19M)

CARO.01 Bhaskar CNO - CARO.040 New Course—(SM25/S24M/J25M)

Companies exempted from reporting under Companies (Auditor’s Report) Order, 2020.

OR

Discuss which class of companies are specifically exempt from the applicability of CARO 2020.

OR

CARO, 2020 applies to all companies. Discuss.

OR

What are the various types of companies covered under Companies (Auditor’s Report) Order, 2020 [CARO,

2020]?

OR

Mr. Chetan is appointed as an auditor of Spot Limited, a small company. Mr. Chetan is aware that CARO

2020 is not applicable to small company. List out the classes of companies that are specifically exempt

from the applicability of CARO 2020.

Answer Companies Exempted from Reporting under CARO, 2020

➢ The CARO, 2020 is an additional reporting requirement Order. The order applies to every company

including a foreign company as defined in clause (42) of section 2 of the Companies Act, 2013.

➢ However, the Order specifically exempts the following class of companies- (IB-COPS)

• a Banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949;

• an Insurance company as defined under the Insurance Act,1938;

• a Company licensed to operate under section 8 of the Companies Act;

• a One Person Company as defined under clause (62) of sect ion 2 of the Companies Act;

• a Small company as defined under clause (85) of section 2 of the Companies Act; and

• a Private limited company, not being a subsidiary or holding company of a public company,

having a paid up capital and reserves and surplus not more than 1 crore as on the balance sheet

date and which does not have total borrowings exceeding 1 crore from any bank or financial

institution at any point of time during the financial year and which does not have a total revenue

as disclosed in Scheduled III to the Companies Act, 2013 (including revenue from discontinuing

operations) exceeding Rs 10 crore during the financial year as per the financial statements.

➢ It may be noted that the Order shall not be applicable to the auditor’s report on consolidated

financial statements.

QNO CARO (Applicability - Private Company) Old Course--(M19R)

CARO.03 Bhaskar CNO - CARO.040

Ashu Pvt. Ltd. has fully paid capital and reserves of Rs 50 lakh. During the year, the company had borrowed

Rs 70 lakh each from a bank and a financial institution independently. It has the turnover of 900 lakh.

Answer ➢ Applicability of Order:

The CARO, 2020 is an additional reporting requirement Order. The order applies to every company

including a foreign company as defined in clause (42) of section 2 of the Companies Act, 2013.

However, the Order specifically exempts the following class of companies-

• a Banking company as defined in clause (c) of section 5 of the Banking Regulation Act, 1949;

• an Insurance company as defined under the Insurance Act,1938;

• a Company licensed to operate under section 8 of the Companies Act;

• a One Person Company as defined under clause (62) of section 2 of the Companies Act;

• a Small company as defined under clause (85) of section 2 of the Companies Act; and

• a Private limited company, not being a subsidiary or holding company of a public company,

having a paid up capital and reserves and surplus not more than 1 crore as on the balance

www.auditguru.in 8.25