Page 256 - CA Inter Audit PARAM

P. 256

CA Ravi Taori

sheet date and which does not have total borrowings exceeding 1 crore from any bank or

financial institution at any point of time during the financial year and which does not have

a total revenue as disclosed in Scheduled III to the Companies Act, 2013 (including revenue

from discontinuing operations) exceeding Rs 10 crore during the financial year as per the

financial statements.

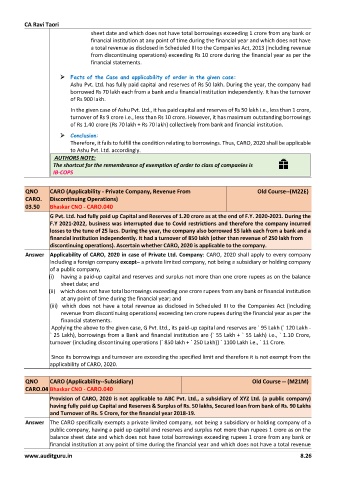

➢ Facts of the Case and applicability of order in the given case:

Ashu Pvt. Ltd. has fully paid capital and reserves of Rs 50 lakh. During the year, the company had

borrowed Rs 70 lakh each from a bank and a financial institution independently. It has the turnover

of Rs 900 lakh.

In the given case of Ashu Pvt. Ltd., it has paid capital and reserves of Rs 50 lakh i.e., less than 1 crore,

turnover of Rs 9 crore i.e., less than Rs 10 crore. However, it has maximum outstanding borrowings

of Rs 1.40 crore (Rs 70 lakh + Rs 70 lakh) collectively from bank and financial institution.

➢ Conclusion:

Therefore, it fails to fulfill the condition relating to borrowings. Thus, CARO, 2020 shall be applicable

to Ashu Pvt. Ltd. accordingly.

AUTHORS NOTE:

The shortcut for the remembrance of exemption of order to class of companies is

IB-COPS

QNO CARO (Applicability - Private Company, Revenue From Old Course--(M22E)

CARO. Discontinuing Operations)

03.50 Bhaskar CNO - CARO.040

G Pvt. Ltd. had fully paid up Capital and Reserves of 1.20 crore as at the end of F.Y. 2020-2021. During the

F.Y 2021-2022, business was interrupted due to Covid restrictions and therefore the company incurred

losses to the tune of 25 lacs. During the year, the company also borrowed 55 lakh each from a bank and a

financial institution independently. It had a turnover of 850 lakh (other than revenue of 250 lakh from

discontinuing operations). Ascertain whether CARO, 2020 is applicable to the company.

Answer Applicability of CARO, 2020 in case of Private Ltd. Company: CARO, 2020 shall apply to every company

including a foreign company except– a private limited company, not being a subsidiary or holding company

of a public company,

(i) having a paid-up capital and reserves and surplus not more than one crore rupees as on the balance

sheet date; and

(ii) which does not have total borrowings exceeding one crore rupees from any bank or financial institution

at any point of time during the financial year; and

(iii) which does not have a total revenue as disclosed in Scheduled III to the Companies Act (including

revenue from discontinuing operations) exceeding ten crore rupees during the financial year as per the

financial statements.

Applying the above to the given case, G Pvt. Ltd., its paid-up capital and reserves are ` 95 Lakh (` 120 Lakh -

` 25 Lakh), borrowings from a Bank and financial institution are (` 55 Lakh + ` 55 Lakh) i.e., ` 1.10 Crore,

turnover {including discontinuing operations (` 850 lakh + ` 250 Lakh)} ` 1100 Lakh i.e., ` 11 Crore.

Since its borrowings and turnover are exceeding the specified limit and therefore it is not exempt from the

applicability of CARO, 2020.

QNO CARO (Applicability--Subsidiary) Old Course -- (M21M)

CARO.04 Bhaskar CNO - CARO.040

Provision of CARO, 2020 is not applicable to ABC Pvt. Ltd., a subsidiary of XYZ Ltd. (a public company)

having fully paid up Capital and Reserves & Surplus of Rs. 50 lakhs, Secured loan from bank of Rs. 90 Lakhs

and Turnover of Rs. 5 Crore, for the financial year 2018-19.

Answer The CARO specifically exempts a private limited company, not being a subsidiary or holding company of a

public company, having a paid up capital and reserves and surplus not more than rupees 1 crore as on the

balance sheet date and which does not have total borrowings exceeding rupees 1 crore from any bank or

financial institution at any point of time during the financial year and which does not have a total revenue

www.auditguru.in 8.26