Page 12 - 12. COMPILER QB - INDAS 19

P. 12

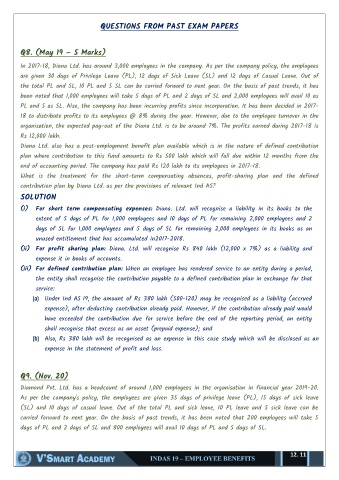

QUESTIONS FROM PAST EXAM PAPERS

Q8. (May 19 – 5 Marks)

In 2017-18, Diana Ltd. has around 3,000 employees in the company. As per the company policy, the employees

are given 30 days of Privilege Leave (PL), 12 days of Sick Leave (SL) and 12 days of Casual Leave. Out of

the total PL and SL, 10 PL and 5 SL can be carried forward to next year. On the basis of past trends, it has

been noted that 1,000 employees will take 5 days of PL and 2 days of SL and 2,000 employees will avail 10 as

PL and 5 as SL. Also, the company has been incurring profits since incorporation. It has been decided in 2017-

18 to distribute profits to its employees @ 8% during the year. However, due to the employee turnover in the

organisation, the expected pay-out of the Diana Ltd. is to be around 7%. The profits earned during 2017-18 is

Rs 12,000 lakh.

Diana Ltd. also has a post-employment benefit plan available which is in the nature of defined contribution

plan where contribution to this fund amounts to Rs 500 lakh which will fall due within 12 months from the

end of accounting period. The company has paid Rs 120 lakh to its employees in 2017-18.

What is the treatment for the short-term compensating absences, profit-sharing plan and the defined

contribution plan by Diana Ltd. as per the provisions of relevant Ind AS?

SOLUTION

(i) For short term compensating expenses: Diana. Ltd. will recognise a liability in its books to the

extent of 5 days of PL for 1,000 employees and 10 days of PL for remaining 2,000 employees and 2

days of SL for 1,000 employees and 5 days of SL for remaining 2,000 employees in its books as an

unused entitlement that has accumulated in2017-2018.

(ii) For profit sharing plan: Diana. Ltd. will recognise Rs 840 lakh (12,000 x 7%) as a liability and

expense it in books of accounts.

(iii) For defined contribution plan: When an employee has rendered service to an entity during a period,

the entity shall recognise the contribution payable to a defined contribution plan in exchange for that

service:

(a) Under Ind AS 19, the amount of Rs 380 lakh (500-120) may be recognised as a liability (accrued

expense), after deducting contribution already paid. However, if the contribution already paid would

have exceeded the contribution due for service before the end of the reporting period, an entity

shall recognise that excess as an asset (prepaid expense); and

(b) Also, Rs 380 lakh will be recognised as an expense in this case study which will be disclosed as an

expense in the statement of profit and loss.

Q9. (Nov. 20)

Diamond Pvt. Ltd. has a headcount of around 1,000 employees in the organisation in financial year 2019-20.

As per the company's policy, the employees are given 35 days of privilege leave (PL), 15 days of sick leave

(SL) and 10 days of casual leave. Out of the total PL and sick leave, 10 PL leave and 5 sick leave can be

carried forward to next year. On the basis of past trends, it has been noted that 200 employees will take 5

days of PL and 2 days of SL and 800 employees will avail 10 days of PL and 5 days of SL.

12. 11