Page 29 - CA Final PARAM Digital Book.

P. 29

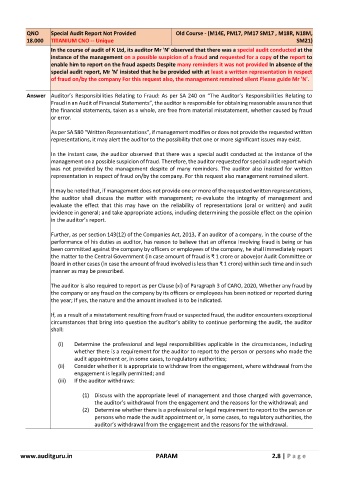

QNO Special Audit Report Not Provided Old Course - (M14E, PM17, PM17 SM17 , M18R, N18M,

18.000 TITANIUM CNO -- Unique SM21)

In the course of audit of K Ltd, its auditor Mr 'N' observed that there was a special audit conducted at the

instance of the management on a possible suspicion of a fraud and requested for a copy of the report to

enable him to report on the fraud aspects Despite many reminders it was not provided In absence of the

special audit report, Mr 'N' insisted that he be provided with at least a written representation in respect

of fraud on/by the company For this request also, the management remained silent Please guide Mr 'N'.

Answer Auditor’s Responsibilities Relating to Fraud: As per SA 240 on “The Auditor’s Responsibilities Relating to

Fraud in an Audit of Financial Statements”, the auditor is responsible for obtaining reasonable assurance that

the financial statements, taken as a whole, are free from material misstatement, whether caused by fraud

or error.

As per SA 580 “Written Representations”, if management modifies or does not provide the requested written

representations, it may alert the auditor to the possibility that one or more significant issues may exist.

In the instant case, the auditor observed that there was a special audit conducted at the instance of the

management on a possible suspicion of fraud. Therefore, the auditor requested for special audit report which

was not provided by the management despite of many reminders. The auditor also insisted for written

representation in respect of fraud on/by the company. For this request also management remained silent.

It may be noted that, if management does not provide one or more of the requested written representations,

the auditor shall discuss the matter with management; re-evaluate the integrity of management and

evaluate the effect that this may have on the reliability of representations (oral or written) and audit

evidence in general; and take appropriate actions, including determining the possible effect on the opinion

in the auditor’s report.

Further, as per section 143(12) of the Companies Act, 2013, if an auditor of a company, in the course of the

performance of his duties as auditor, has reason to believe that an offence involving fraud is being or has

been committed against the company by officers or employees of the company, he shall immediately report

the matter to the Central Government (in case amount of fraud is ₹ 1 crore or above)or Audit Committee or

Board in other cases (in case the amount of fraud involved is less than ₹ 1 crore) within such time and in such

manner as may be prescribed.

The auditor is also required to report as per Clause (xi) of Paragraph 3 of CARO, 2020, Whether any fraud by

the company or any fraud on the company by its officers or employees has been noticed or reported during

the year; If yes, the nature and the amount involved is to be indicated.

If, as a result of a misstatement resulting from fraud or suspected fraud, the auditor encounters exceptional

circumstances that bring into question the auditor’s ability to continue performing the audit, the auditor

shall:

(i) Determine the professional and legal responsibilities applicable in the circumstances, including

whether there is a requirement for the auditor to report to the person or persons who made the

audit appointment or, in some cases, to regulatory authorities;

(ii) Consider whether it is appropriate to withdraw from the engagement, where withdrawal from the

engagement is legally permitted; and

(iii) If the auditor withdraws:

(1) Discuss with the appropriate level of management and those charged with governance,

the auditor’s withdrawal from the engagement and the reasons for the withdrawal; and

(2) Determine whether there is a professional or legal requirement to report to the person or

persons who made the audit appointment or, in some cases, to regulatory authorities, the

auditor’s withdrawal from the engagement and the reasons for the withdrawal.

www.auditguru.in PARAM 2.8 | P a g e