Page 12 - Chap2 RCM

P. 12

Ø Therefore, Vimal Goods transport agency is liable to pay GST under forward charge.

Ø In the second case, if GTA has not exercised the option to pay tax under forward charge, then XYZ

Ltd., being a specified recipient, is liable to tax under reverse charge.

(v) Legal Provision:- As per section 9(3) of CGST Act, If sponsorship services are provided by any person

other than a body corporate to Any body corporate or partnership firm located in the taxable territory,

then GST is payable on reverse charge basis by recipient.

Discussion & Conclusion:-

Ø In the given case, sponsorship services have been provided by Partnership firm to an individual.

Ø Thus, the reverse charge provisions will not be attracted here.

Ø So, Partnership firm i.e. the supplier is liable to pay GST under forward charge.

(vi) Legal Provision: If an unregistered person provides a service by way of renting of immovable property

other than a residential dwelling to a registered person other than one paying tax under the composition

scheme, the GST liability falls under the Reverse Charge Mechanism. [Sec 9(3)]

Conclusion:

Ø In the first case, M/s TechNova Pvt. Ltd. is liable to pay tax under RCM.

Ø In the Second case, No tax is payable as M/s TechNova Pvt. Ltd. opts for Composition Scheme.

03. Section 9(4):- RCM in case of supply of specified categories of goods &/or services by

an unregistered supplier to specified class of registered persons

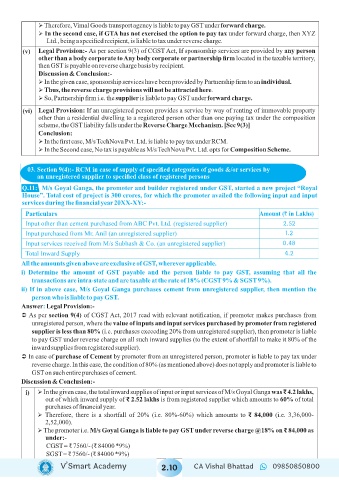

Q.11: M/s Goyal Ganga, the promoter and builder registered under GST, started a new project “Royal

House”. Total cost of project is 300 crores, for which the promoter availed the following input and input

services during the financial year 20XX-XY:-

Particulars Amount (` in Lakhs)

Input other than cement purchased from ABC Pvt. Ltd. (registered supplier) 2.52

Input purchased from Mr. Anil (an unregistered supplier) 1.2

Input services received from M/s Subhash & Co. (an unregistered supplier) 0.48

Total Inward Supply 4.2

All the amounts given above are exclusive of GST, wherever applicable.

i) Determine the amount of GST payable and the person liable to pay GST, assuming that all the

transactions are intra-state and are taxable at the rate of 18% (CGST 9% & SGST 9%).

ii) If in above case, M/s Goyal Ganga purchases cement from unregistered supplier, then mention the

person who is liable to pay GST.

Answer Legal Provision:-:

Ü As per section 9(4) of CGST Act, 2017 read with relevant notification, if promoter makes purchases from

unregistered person, where the value of inputs and input services purchased by promoter from registered

supplier is less than 80% (i.e. purchases exceeding 20% from unregistered supplier), then promoter is liable

to pay GST under reverse charge on all such inward supplies (to the extent of shortfall to make it 80% of the

inward supplies from registered supplier).

Ü In case of purchase of Cement by promoter from an unregistered person, promoter is liable to pay tax under

reverse charge. In this case, the condition of 80% (as mentioned above) does not apply and promoter is liable to

GST on such entire purchases of cement.

Discussion & Conclusion:-

i) Ø In the given case, the total inward supplies of input or input services of M/s Goyal Ganga was ₹ 4.2 lakhs,

out of which inward supply of ₹ 2.52 lakhs is from registered supplier which amounts to 60% of total

purchases of financial year.

Ø Therefore, there is a shortfall of 20% (i.e. 80%-60%) which amounts to ₹ 84,000 (i.e. 3,36,000-

2,52,000).

Ø The promoter i.e. M/s Goyal Ganga is liable to pay GST under reverse charge @18% on ₹ 84,000 as

under:-

CGST = ₹ 7560/- (₹ 84000 *9%)

SGST = ₹ 7560/- (₹ 84000 *9%)

V’Smart Academy 2.10 CA Vishal Bhattad 09850850800