Page 7 - Chap2 RCM

P. 7

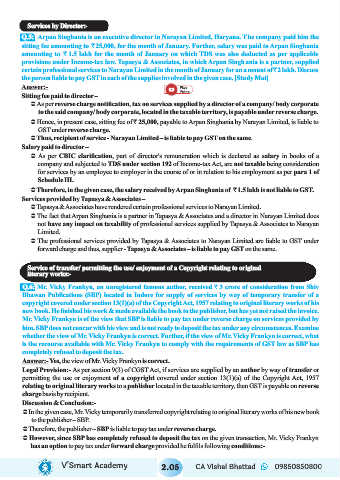

Services by Director:-

Q.5: Arpan Singhania is an executive director in Narayan Limited, Haryana. The company paid him the

sitting fee amounting to ` 25,000, for the month of January. Further, salary was paid to Arpan Singhania

amounting to ` 1.5 lakh for the month of January on which TDS was also deducted as per applicable

provisions under Income-tax law. Tapasya & Associates, in which Arpan Singhania is a partner, supplied

certain professional services to Narayan Limited in the month of January for an amount of ` 2 lakh. Discuss

the person liable to pay GST in each of the supplies involved in the given case. [Study Mat]

Answer:-

Sitting fee paid to director –

Ü As per reverse charge notification, tax on services supplied by a director of a company/ body corporate

to the said company/ body corporate, located in the taxable territory, is payable under reverse charge.

Ü Hence, in present case, sitting fee of ` 25,000, payable to Arpan Singhania by Narayan Limited, is liable to

GST under reverse charge.

Ü Thus, recipient of service - Narayan Limited – is liable to pay GST on the same.

Salary paid to director –

Ü As per CBIC clarification, part of director's remuneration which is declared as salary in books of a

company and subjected to TDS under section 192 of Income-tax Act, are not taxable being consideration

for services by an employee to employer in the course of or in relation to his employment as per para 1 of

Schedule III.

Ü Therefore, in the given case, the salary received by Arpan Singhania of ` 1.5 lakh is not liable to GST.

Services provided by Tapasya & Associates –

Ü Tapasya & Associates have rendered certain professional services to Narayan Limited.

Ü The fact that Arpan Singhania is a partner in Tapasya & Associates and a director in Narayan Limited does

not have any impact on taxability of professional services supplied by Tapasya & Associates to Narayan

Limited.

Ü The professional services provided by Tapasya & Associates to Narayan Limited are liable to GST under

forward charge and thus, supplier - Tapasya & Associates – is liable to pay GST on the same.

Service of transfer/ permitting the use/ enjoyment of a Copyright relating to original

literary works:-

Q.6: Mr. Vicky Frankyn, an unregistered famous author, received ` 3 crore of consideration from Shiv

Bhawan Publications (SBP) located in Indore for supply of services by way of temporary transfer of a

copyright covered under section 13(1)(a) of the Copyright Act, 1957 relating to original literary works of his

new book. He finished his work & made available the book to the publisher, but has yet not raised the invoice.

Mr. Vicky Frankyn is of the view that SBP is liable to pay tax under reverse charge on services provided by

him. SBP does not concur with his view and is not ready to deposit the tax under any circumstances. Examine

whether the view of Mr. Vicky Frankyn is correct. Further, if the view of Mr. Vicky Frankyn is correct, what

is the recourse available with Mr. Vicky Frankyn to comply with the requirements of GST law as SBP has

completely refused to deposit the tax.

Answer:- Yes, the view of Mr. Vicky Frankyn is correct.

Legal Provision:- As per section 9(3) of CGST Act, if services are supplied by an author by way of transfer or

permitting the use or enjoyment of a copyright covered under section 13(1)(a) of the Copyright Act, 1957

relating to original literary works to a publisher located in the taxable territory, then GST is payable on reverse

charge basis by recipient.

Discussion & Conclusion:-

Ü In the given case, Mr. Vicky temporarily transferred copyright relating to original literary works of his new book

to the publisher – SBP.

Ü Therefore, the publisher – SBP is liable to pay tax under reverse charge.

Ü However, since SBP has completely refused to deposit the tax on the given transaction, Mr. Vicky Frankyn

has an option to pay tax under forward charge provided he fulfils following conditions:-

V’Smart Academy 2.05 CA Vishal Bhattad 09850850800