Page 6 - Chap2 RCM

P. 6

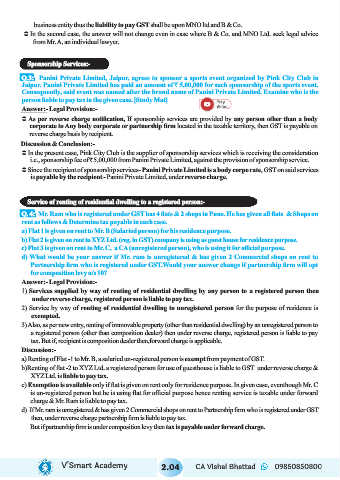

business entity thus the liability to pay GST shall be upon MNO ltd and B & Co.

Ü In the second case, the answer will not change even in case where B & Co. and MNO Ltd. seek legal advice

from Mr. A, an individual lawyer.

Sponsorship Services:-

Q.3: Panini Private Limited, Jaipur, agrees to sponsor a sports event organized by Pink City Club in

Jaipur. Panini Private Limited has paid an amount of ` 5,00,000 for such sponsorship of the sports event.

Consequently, said event was named after the brand name of Panini Private Limited. Examine who is the

person liable to pay tax in the given case. [Study Mat]

Answer:- Legal Provision:-

Ü As per reverse charge notification, If sponsorship services are provided by any person other than a body

corporate to Any body corporate or partnership firm located in the taxable territory, then GST is payable on

reverse charge basis by recipient.

Discussion & Conclusion:-

Ü In the present case, Pink City Club is the supplier of sponsorship services which is receiving the consideration

i.e., sponsorship fee of ` 5,00,000 from Panini Private Limited, against the provision of sponsorship service.

Ü Since the recipient of sponsorship services- Panini Private Limited is a body corporate, GST on said services

is payable by the recipient - Panini Private Limited, under reverse charge.

Service of renting of residential dwelling to a registered person:-

Q. 4: Mr. Ram who is registered under GST has 4 flats & 2 shops in Pune. He has given all flats & Shops on

rent as follows & Determine tax payable in each case.

a) Flat 1 is given on rent to Mr. B (Salaried person) for his residence purpose.

b) Flat 2 is given on rent to XYZ Ltd. (reg. in GST) company is using as guest house for residence purpose.

c) Flat 3 is given on rent to Mr. C, a CA (unregistered person), who is using it for official purpose.

d) What would be your answer if Mr. ram is unregistered & has given 2 Commercial shops on rent to

Partnership firm who is registered under GST.Would your answer change if partnership firm will opt

for composition levy u/s 10?

Answer:- Legal Provision:-

1) Services supplied by way of renting of residential dwelling by any person to a registered person then

under reverse charge, registered person is liable to pay tax.

2) Service by way of renting of residential dwelling to unregistered person for the purpose of residence is

exempted.

3) Also, as per new entry, renting of immovable property (other than residential dwelling) by an unregistered person to

a registered person (other than composition dealer) then under reverse charge, registered person is liable to pay

tax. But if, recipient is composition dealer then,forward charge is applicable.

Discussion:-

a) Renting of Flat -1 to Mr. B, a salaried un-registered person is exempt from payment of GST.

b)Renting of flat -2 to XYZ Ltd. a registered person for use of guesthouse is liable to GST under reverse charge &

XYZ Ltd. is liable to pay tax.

c) Exemption is available only if flat is given on rent only for residence purpose. In given case, eventhough Mr. C

is un-registered person but he is using flat for official purpose hence renting service is taxable under forward

charge & Mr. Ram is liable to pay tax.

d) If Mr. ram is unregistered & has given 2 Commercial shops on rent to Partnership firm who is registered under GST

then, under reverse charge partnership firm is liable to pay tax.

But if partnership firm is under composition levy then tax is payable under forward charge.

V’Smart Academy 2.04 CA Vishal Bhattad 09850850800