Page 173 - CA Inter Audit PARAM

P. 173

CA Ravi Taori

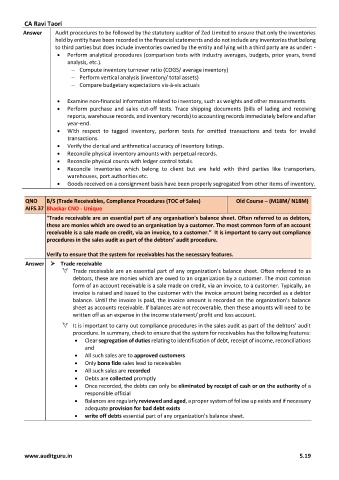

Answer Audit procedures to be followed by the statutory auditor of Zed Limited to ensure that only the inventories

held by entity have been recorded in the financial statements and do not include any inventories that belong

to third parties but does include inventories owned by the entity and lying with a third party are as under: -

• Perform analytical procedures (comparison tests with industry averages, budgets, prior years, trend

analysis, etc.).

− Compute inventory turnover ratio (COGS/ average inventory)

− Perform vertical analysis (inventory/ total assets)

− Compare budgetary expectations vis-à-vis actuals

• Examine non-financial information related to inventory, such as weights and other measurements.

• Perform purchase and sales cut-off tests. Trace shipping documents (bills of lading and receiving

reports, warehouse records, and inventory records) to accounting records immediately before and after

year-end.

• With respect to tagged inventory, perform tests for omitted transactions and tests for invalid

transactions.

• Verify the clerical and arithmetical accuracy of inventory listings.

• Reconcile physical inventory amounts with perpetual records.

• Reconcile physical counts with ledger control totals.

• Reconcile inventories which belong to client but are held with third parties like transporters,

warehouses, port authorities etc.

• Goods received on a consignment basis have been properly segregated from other items of inventory.

QNO B/S (Trade Receivables, Compliance Procedures (TOC of Sales) Old Course – (M18M/ N18M)

AIFS.37 Bhaskar CNO - Unique

“Trade receivable are an essential part of any organisation's balance sheet. Often referred to as debtors,

these are monies which are owed to an organisation by a customer. The most common form of an account

receivable is a sale made on credit, via an invoice, to a customer.” It is important to carry out compliance

procedures in the sales audit as part of the debtors’ audit procedure.

Verify to ensure that the system for receivables has the necessary features.

Answer ➢ Trade receivable

Trade receivable are an essential part of any organization’s balance sheet. Often referred to as

debtors, these are monies which are owed to an organization by a customer. The most common

form of an account receivable is a sale made on credit, via an invoice, to a customer. Typically, an

invoice is raised and issued to the customer with the invoice amount being recorded as a debtor

balance. Until the invoice is paid, the invoice amount is recorded on the organization’s balance

sheet as accounts receivable. If balances are not recoverable, then these amounts will need to be

written off as an expense in the income statement/ profit and loss account.

It is important to carry out compliance procedures in the sales audit as part of the debtors’ audit

procedure. In summary, check to ensure that the system for receivables has the following features:

• Clear segregation of duties relating to identification of debt, receipt of income, reconciliations

and

• All such sales are to approved customers

• Only bona fide sales lead to receivables

• All such sales are recorded

• Debts are collected promptly

• Once recorded, the debts can only be eliminated by receipt of cash or on the authority of a

responsible official

• Balances are regularly reviewed and aged, a proper system of follow up exists and if necessary

adequate provision for bad debt exists

• write off debts essential part of any organization’s balance sheet.

www.auditguru.in 5.19