Page 12 - CHAPTER 3 (1).cdr

P. 12

does not crosses the limit of ₹ 20 lakhs. Sec.9(4) RCM

In the meanwhile, it has availed the service by way of renting of motor 11. Value of inputs and input services purchased from registered

vehicle from Mr. Poonawala for the total consideration of ₹ 1.5 lakhs on 5th supplier is less than 80%

October 2019 (including cost of fuel). CCP 03.11.20.00

CH 3

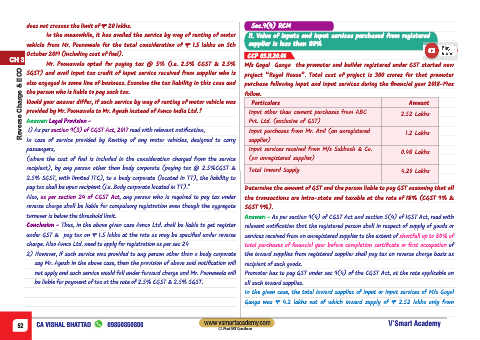

SGST) and avail input tax credit of input service received from supplier who is M/s Goyal Ganga the promoter and builder registered under GST started new

Mr. Poonawala opted for paying tax @ 5% (i.e. 2.5% CGST & 2.5%

Reverse Charge & ECO the person who is liable to pay such tax. purchase following input and input services during the financial year 2018-19as

project “Royal House”. Total cost of project is 300 crores for that promoter

also engaged in same line of business. Examine the tax liability in this case and

follow.

Would your answer differ, if such service by way of renting of motor vehicle was

Amount

Particulars

provided by Mr. Poonawala to Mr. Ayush instead of Amco India Ltd.?

Input other than cement purchases from ABC

2.52 Lakhs

Answer: Legal Provision -

Pvt. Ltd. (exclusive of GST)

1) As per

section 9(3) of CGST Act, 2017 read with relevant notification,

In case of service provided by Renting of any motor vehicles, designed to carry Input purchases from Mr. Anil (an unregistered 1.2 Lakhs

supplier)

passangers, Input services received from M/s Subhash & Co.

0.48 Lakhs

(where the cost of fuel is included in the consideration charged from the service (an unregistered supplier)

recipient), by any person other than body corporate (paying tax @ 2.5%CGST & Total Inward Supply 4.20 Lakhs

2.5% SGST, with limited ITC), to a body corporate (located in TT), the liability to

pay tax shall be upon recipient (i.e. Body corporate located in TT)." Determine the amount of GST and the person liable to pay GST assuming that all

Also, as per section 24 of CGST Act , any person who is required to pay tax under the transactions are intra-state and taxable at the rate of 18% (CGST 9% &

reverse charge shall be liable for compulsory registration even though the aggregate SGST 9%).

turnover is below the threshold limit. Answer: - As per section 9(4) of CGST Act and section 5(4) of IGST Act, read with

Conclusion - Thus, in the above given case Amco Ltd. shall be liable to get register relevant notification that the registered person shall in respect of supply of goods or

under GST & pay tax on ₹ 1.5 lakhs at the rate as may be specified under reverse services received from an unregistered supplier to the extent of shortfall up to 80% of

charge. Also Amco Ltd. need to apply for registration as per sec 24 total purchases of financial year before completion certificate or first occupation of

2) However, if such service was provided to any person other than a body corporate the inward supplies from registered supplier shall pay tax on reverse charge basis as

say Mr. Ayush in the above case, then the provision of above said notification will recipient of such goods.

not apply and such service would fall under forward charge and Mr. Poonawala will Promoter has to pay GST under sec 9(4) of the CGST Act, at the rate applicable on

be liable for payment of tax at the rate of 2.5% CGST & 2.5% SGST. all such inward supplies.

In the given case, the total inward supplies of input or input services of M/s Goyal

Ganga was ₹ 4.2 lakhs out of which inward supply of ₹ 2.52 lakhs only from

www.vsmartacademy.com

52 CA VISHAL BHATTAD 09850850800 V’Smart Academy

CA Final GST Questioner