Page 9 - CHAPTER 3 (1).cdr

P. 9

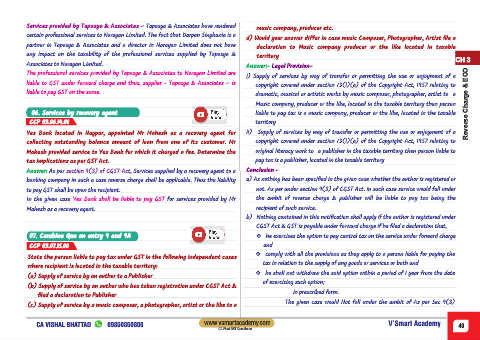

Services provided by Tapasya & Associates – Tapasya & Associates have rendered music company, producer etc.

certain professional services to Narayan Limited. The fact that Darpan Singhania is a d) Would your answer differ in case music Composer, Photographer, Artist file a

partner in Tapasya & Associates and a director in Narayan Limited does not have declaration to Music company producer or the like located in taxable

any impact on the taxability of the professional services supplied by Tapasya & territory

CH 3

Associates to Narayan Limited. Answer:- Legal Provision-

The professional services provided by Tapasya & Associates to Narayan Limited are i) Supply of services by way of transfer or permitting the use or enjoyment of a

liable to GST under forward charge and thus, supplier - Tapasya & Associates – is copyright covered under section 13(1)(a) of the Copyright Act, 1957 relating to

liable to pay GST on the same. dramatic, musical or artistic works by music composer, photographer, artist to a

Music company, producer or the like, located in the taxable territory then person Reverse Charge & ECO

06. Services by recovery agent liable to pay tax is a music company, producer or the like, located in the taxable

CCP 03.06.14.00 territory

Yes Bank located in Nagpur, appointed Mr Mahesh as a recovery agent for ii) Supply of services by way of transfer or permitting the use or enjoyment of a

collecting outstanding balance amount of loan from one of its customer. Mr copyright covered under section 13(1)(a) of the Copyright Act, 1957 relating to

Mahesh provided service to Yes Bank for which it charged a fee. Determine the original literacy work to a publisher in the taxable territory then person liable to

tax implications as per GST Act. pay tax is a publisher, located in the taxable territory

Answer: As per section 9(3) of CGST Act , Services supplied by a recovery agent to a Conclusion -

banking company in such a case reverse charge shall be applicable. Thus the liability a) As nothing has been specified in the given case whether the author is registered or

to pay GST shall be upon the recipient. not. As per under section 9(3) of CGST Act. in such case service would fall under

In the given case Yes Bank shall be liable to pay GST for services provided by Mr the ambit of reverse charge & publisher will be liable to pay tax being the

Mahesh as a recovery agent. recipient of such service.

b) Nothing contained in this notification shall apply if the author is registered under

CGST Act & GST is payable under forward charge if he filed a declaration that,

07. Combine Que on entry 9 and 9A v he exercises the option to pay central tax on the service under forward charge

CCP 03.07.15.00 and

v comply with all the provisions as they apply to a person liable for paying the

State the person liable to pay tax under GST in the following independent cases

tax in relation to the supply of any goods or services or both and

where recipient is located in the taxable territory:

v he shall not withdraw the said option within a period of 1 year from the date

(a) Supply of service by an author to a Publisher

of exercising such option;

(b) Supply of service by an author who has taken registration under CGST Act &

in prescribed form.

filed a declaration to Publisher

The given case would Not fall under the ambit of As per Sec 9(3)

(c) Supply of service by a music composer, a photographer, artist or the like to a

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 49

CA Final GST Questioner