Page 18 - Chapter 9 Registration

P. 18

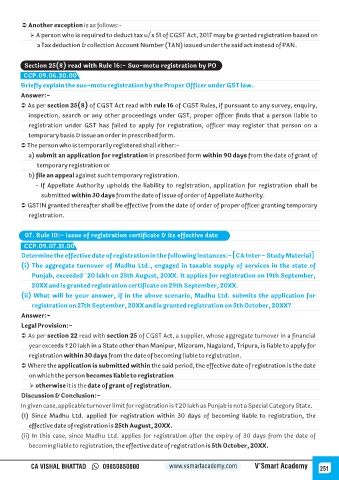

Ü Another exception is as follows:-

Ø A person who is required to deduct tax u/s 51 of CGST Act, 2017 may be granted registration based on

a Tax deduction & collection Account Number (TAN) issued under the said act instead of PAN.

Section 25(8) read with Rule 16:- Suo-motu registration by PO

CCP.09.06.20.00

Briefly explain the suo-motu registration by the Proper Officer under GST law.

Answer:-

Ü As per section 25(8) of CGST Act read with rule 16 of CGST Rules, if pursuant to any survey, enquiry,

inspection, search or any other proceedings under GST, proper officer finds that a person liable to

registration under GST has failed to apply for registration, officer may register that person on a

temporary basis & issue an order in prescribed form.

Ü The person who is temporarily registered shall either:-

a) submit an application for registration in prescribed form within 90 days from the date of grant of

temporary registration or

b) file an appeal against such temporary registration.

- If Appellate Authority upholds the liability to registration, application for registration shall be

submitted within 30 days from the date of issue of order of Appellate Authority.

Ü GSTIN granted thereafter shall be effective from the date of order of proper officer granting temporary

registration.

07. Rule 10:- Issue of registration certificate & its effective date

CCP.09.07.21.00

Determine the effective date of registration in the following instances:- [CA Inter - Study Material]

(i) The aggregate turnover of Madhu Ltd., engaged in taxable supply of services in the state of

Punjab, exceeded ` 20 lakh on 25th August, 20XX. It applies for registration on 19th September,

20XX and is granted registration certificate on 29th September, 20XX.

(ii) What will be your answer, if in the above scenario, Madhu Ltd. submits the application for

registration on 27th September, 20XX and is granted registration on 5th October, 20XX?

Answer:-

Legal Provision:-

Ü As per section 22 read with section 25 of CGST Act, a supplier, whose aggregate turnover in a financial

year exceeds ₹ 20 lakh in a State other than Manipur, Mizoram, Nagaland, Tripura, is liable to apply for

registration within 30 days from the date of becoming liable to registration.

Ü Where the application is submitted within the said period, the effective date of registration is the date

on which the person becomes liable to registration

Ø otherwise it is the date of grant of registration.

Discussion & Conclusion:-

In given case, applicable turnover limit for registration is ₹ 20 lakh as Punjab is not a Special Category State.

(I) Since Madhu Ltd. applied for registration within 30 days of becoming liable to registration, the

effective date of registration is 25th August, 20XX.

(ii) In this case, since Madhu Ltd. applies for registration after the expiry of 30 days from the date of

becoming liable to registration, the effective date of registration is 5th October, 20XX.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 251