Page 16 - Chapter 6_Value of Supply

P. 16

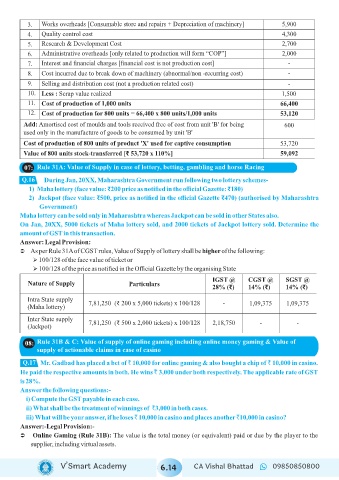

3. Works overheads [Consumable store and repairs + Depreciation of machinery] 5,900

4. Quality control cost 4,300

5. Research & Development Cost 2,700

6. Administrative overheads [only related to production will form “COP”] 2,000

7. Interest and financial charges [financial cost is not production cost] -

8. Cost incurred due to break down of machinery (abnormal/non -recurring cost) -

9. Selling and distribution cost (not a production related cost) -

10. Less : Scrap value realized 1,500

11. Cost of production of 1,000 units 66,400

12. Cost of production for 800 units = 66,400 x 800 units/1,000 units 53,120

Add: Amortised cost of moulds and tools received free of cost from unit 'B' for being 600

used only in the manufacture of goods to be consumed by unit 'B'

Cost of production of 800 units of product 'X' used for captive consumption 53,720

Value of 800 units stock-transferred [₹ 53,720 x 110%] 59,092

07: Rule 31A: Value of Supply in case of lottery, betting, gambling and horse Racing

Q.16

During Jan, 20XX, Maharashtra Government run following two lottery schemes-

1) Maha lottery (face value: ₹200 price as notified in the official Gazette: ₹180)

2) Jackpot (face value: ₹500, price as notified in the official Gazette ₹470) (authorised by Maharashtra

Government)

Maha lottery can be sold only in Maharashtra whereas Jackpot can be sold in other States also.

On Jan, 20XX, 5000 tickets of Maha lottery sold, and 2000 tickets of Jackpot lottery sold. Determine the

amount of GST in this transaction.

Answer: Legal Provision:

Ü As per Rule 31A of CGST rules, Value of Supply of lottery shall be higher of the following:

Ø 100/128 of the face value of ticket or

Ø 100/128 of the price as notified in the Official Gazette by the organising State

IGST @ CGST @ SGST @

Nature of Supply Particulars

28% (₹) 14% (₹) 14% (₹)

Intra State supply 7,81,250 (₹ 200 x 5,000 tickets) x 100/128 - 1,09,375 1,09,375

(Maha lottery)

Inter State supply 7,81,250 (₹ 500 x 2,000 tickets) x 100/128 - -

(Jackpot) 2,18,750

08: Rule 31B & C: Value of supply of online gaming including online money gaming & Value of

supply of actionable claims in case of casino

Q.17 Mr. Gadbad has placed a bet of ` 10,000 for online gaming & also bought a chip of ` 10,000 in casino.

He paid the respective amounts in both. He wins ` 3,000 under both respectively. The applicable rate of GST

is 28%.

Answer the following questions:-

i) Compute the GST payable in each case.

ii) What shall be the treatment of winnings of `3,000 in both cases.

iii) What will be your answer, if he loses ` 10,000 in casino and places another `10,000 in casino?

Answer:-Legal Provision:-

Ü Online Gaming (Rule 31B): The value is the total money (or equivalent) paid or due by the player to the

supplier, including virtual assets.

V’Smart Academy 6.14 CA Vishal Bhattad 09850850800