Page 20 - Chapter 6_Value of Supply

P. 20

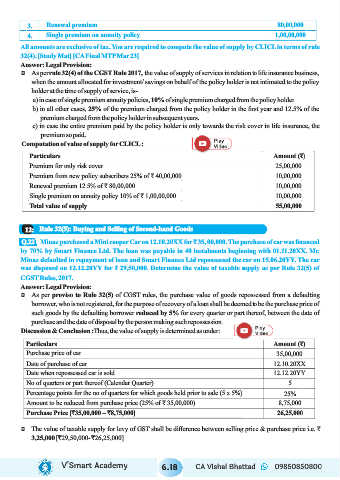

3. Renewal premium 80,00,000

4. Single premium on annuity policy 1,00,00,000

All amounts are exclusive of tax. You are required to compute the value of supply by CLICL in terms of rule

32(4). [Study Mat] [CA Final MTP Mar 23]

Answer: Legal Provision:

Ü As per rule 32(4) of the CGST Rule 2017, the value of supply of services in relation to life insurance business,

when the amount allocated for investment/ savings on behalf of the policy holder is not intimated to the policy

holder at the time of supply of service, is-

a) in case of single premium annuity policies, 10% of single premium charged from the policy holder

b) in all other cases, 25% of the premium charged from the policy holder in the first year and 12.5% of the

premium charged from the policy holder in subsequent years.

c) in case the entire premium paid by the policy holder is only towards the risk cover in life insurance, the

premium so paid.

Computation of value of supply for CLICL :

Particulars Amount (₹)

Premium for only risk cover 25,00,000

Premium from new policy subscribers 25% of ₹ 40,00,000 10,00,000

Renewal premium 12.5% of ₹ 80,00,000 10,00,000

Single premium on annuity policy 10% of ₹ 1,00,00,000 10,00,000

Total value of supply 55,00,000

12: Rule 32(5): Buying and Selling of Second-hand Goods

Minaz purchased a Mini cooper Car on 12.10.20XX for ₹ 35, 00,000. The purchase of car was financed

Q.22

by 70% by Smart Finance Ltd. The loan was payable in 40 instalments beginning with 01.11.20XX. Mr.

Minaz defaulted in repayment of loan and Smart Finance Ltd repossessed the car on 15.06.20YY. The car

was disposed on 12.12.20YY for ₹ 29,50,000. Determine the value of taxable supply as per Rule 32(5) of

CGST Rules, 2017.

Answer: Legal Provision:

Ü As per proviso to Rule 32(5) of CGST rules, the purchase value of goods repossessed from a defaulting

borrower, who is not registered, for the purpose of recovery of a loan shall be deemed to be the purchase price of

such goods by the defaulting borrower reduced by 5% for every quarter or part thereof, between the date of

purchase and the date of disposal by the person making such repossession.

Discussion & Conclusion :Thus, the value of supply is determined as under:

Particulars Amount (₹)

Purchase price of car 35,00,000

Date of purchase of car 12.10.20XX

Date when repossessed car is sold 12.12.20YY

No of quarters or part thereof (Calendar Quarter) 5

Percentage points for the no of quarters for which goods held prior to sale (5 x 5%) 25%

Amount to be reduced from purchase price (25% of ₹ 35,00,000) 8,75,000

Purchase Price [`35,00,000 – `8,75,000] 26,25,000

Ü The value of taxable supply for levy of GST shall be difference between selling price & purchase price i.e. ₹

3,25,000 [ 29,50,000- 26,25,000] ` `

V’Smart Academy 6.18 CA Vishal Bhattad 09850850800