Page 18 - Chapter 6_Value of Supply

P. 18

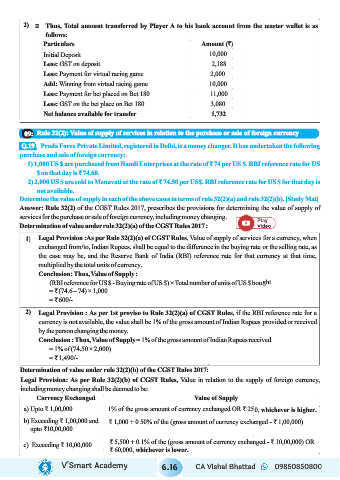

2) Ü Thus, Total amount transferred by Player A to his bank account from the master wallet is as

follows:

Particulars Amount (`)

Initial Deposit 10,000

Less: GST on deposit 2,188

Less: Payment for virtual racing game 2,000

Add: Winning from virtual racing game 10,000

Less: Payment for bet placed on Bet 180 11,000

Less: GST on the bet place on Bet 180 3,080

Net balance available for transfer 1,732

09: Rule 32(2): Value of supply of services in relation to the purchase or sale of foreign currency

Q.19

Prada Forex Private Limited, registered in Delhi, is a money changer. It has undertaken the following

purchase and sale of foreign currency:

1) 1,000 US $ are purchased from Nandi Enterprises at the rate of ₹ 74 per US $. RBI reference rate for US

$ on that day is ₹ 74.60.

2) 2,000 US $ are sold to Menavati at the rate of ₹ 74.50 per US$. RBI reference rate for US $ for that day is

not available.

Determine the value of supply in each of the above cases in terms of rule 32(2)(a) and rule 32(2)(b). [Study Mat]

Answer: Rule 32(2) of the CGST Rules 2017, prescribes the provisions for determining the value of supply of

services for the purchase or sale of foreign currency, including money changing.

Determination of value under rule 32(2)(a) of the CGST Rules 2017 :

1) Legal Provision :As per Rule 32(2)(a) of CGST Rules, Value of supply of services for a currency, when

exchanged from/to, Indian Rupees, shall be equal to the difference in the buying rate or the selling rate, as

the case may be, and the Reserve Bank of India (RBI) reference rate for that currency at that time,

multiplied by the total units of currency.

Conclusion: Thus, Value of Supply :

(RBI reference for US $ - Buying rate of US $) × Total number of units of US $ bought

= ₹ (74.6 – 74) × 1,000

= ₹ 600/-

2) Legal Provision : As per 1st proviso to Rule 32(2)(a) of CGST Rules, if the RBI reference rate for a

currency is not available, the value shall be 1% of the gross amount of Indian Rupees provided or received

by the person changing the money.

Conclusion : Thus, Value of Supply = 1% of the gross amount of Indian Rupees received

= 1% of (74.50 × 2,000)

= ₹ 1,490/-

Determination of value under rule 32(2)(b) of the CGST Rules 2017:

Legal Provision: As per Rule 32(2)(b) of CGST Rules, Value in relation to the supply of foreign currency,

including money changing shall be deemed to be:

Currency Exchanged Value of Supply

a) Upto ₹ 1,00,000 1% of the gross amount of currency exchanged OR ₹ 250, whichever is higher.

b) Exceeding ₹ 1,00,000 and ₹ 1,000 + 0.50% of the (gross amount of currency exchanged - ₹ 1,00,000)

upto ₹10,00,000

₹ 5,500 + 0.1% of the (gross amount of currency exchanged - ₹ 10,00,000) OR

c) Exceeding ₹ 10,00,000

₹ 60,000, whichever is lower.

V’Smart Academy 6.16 CA Vishal Bhattad 09850850800