Page 7 - Chapter 6_Value of Supply

P. 7

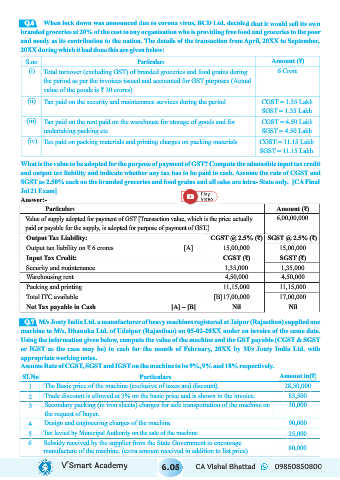

Q.6

When lock down was announced due to corona virus, BCD Ltd. decided that it would sell its own

branded groceries at 20% of the cost to any organisation who is providing free food and groceries to the poor

and needy as its contribution to the nation. The details of the transaction from April, 20XX to September,

20XX during which it had done this are given below:

S.no Particulars Amount (₹)

(i) Total turnover (excluding GST) of branded groceries and food grains during 6 Crore

the period as per the invoices issued and accounted for GST purposes (Actual

value of the goods is ₹ 30 crores)

(ii) Tax paid on the security and maintenance services during the period CGST = 1.35 Lakh

SGST = 1.35 Lakh

(iii) Tax paid on the rent paid on the warehouse for storage of goods and for CGST = 4.50 Lakh

undertaking packing etc SGST = 4.50 Lakh

(iv) Tax paid on packing materials and printing charges on packing materials CGST = 11.15 Lakh

SGST = 11.15 Lakh

What is the value to be adopted for the purpose of payment of GST? Compute the admissible input tax credit

and output tax liability and indicate whether any tax has to be paid in cash. Assume the rate of CGST and

SGST as 2.50% each on the branded groceries and food grains and all sales are intra- State only. [CA Final

Jul 21 Exam]

Answer:-

Particulars Amount (₹)

Value of supply adopted for payment of GST [Transaction value, which is the price actually 6,00,00,000

paid or payable for the supply, is adopted for purpose of payment of GST.]

Output Tax Liability: CGST @ 2.5% (₹) SGST @ 2.5% (₹)

Output tax liability on ₹ 6 crores [A] 15,00,000 15,00,000

Input Tax Credit: CGST (₹) SGST (₹)

Security and maintenance 1,35,000 1,35,000

Warehousing rent 4,50,000 4,50,000

Packing and printing 11,15,000 11,15,000

Total ITC available [B] 17,00,000 17,00,000

Net Tax payable in Cash [A] – [B] Nil Nil

M/s Jonty India Ltd. a manufacturer of heavy machines registered at Jaipur (Rajasthan) supplied one

Q.7

machine to M/s. Dhanuka Ltd. of Udaipur (Rajasthan) on 05-02-20XX under an invoice of the same date.

Using the information given below, compute the value of the machine and the GST payable (CGST & SGST

or IGST as the case may be) in cash for the month of February, 20XX by M/s Jonty India Ltd. with

appropriate working notes.

Assume Rate of CGST, SGST and IGST on the machine to be 9%, 9% and 18% respectively.

SI.No Particulars Amount in(₹)

1 The Basic price of the machine (exclusive of taxes and discount). 28,50,000

2 Trade discount is allowed at 3% on the basic price and is shown in the invoice. 85,500

3 Secondary packing (in iron sheets) charges for safe transportation of the machine on 30,000

the request of buyer.

4 Design and engineering charges of the machine 90,000

5 Tax levied by Municipal Authority on the sale of the machine. 25,000

6 Subsidy received by the supplier from the State Government to encourage 80,000

manufacture of the machine. (extra amount received in addition to list price)

V’Smart Academy 6.05 CA Vishal Bhattad 09850850800