Page 10 - Chapter 14 Return.cdr

P. 10

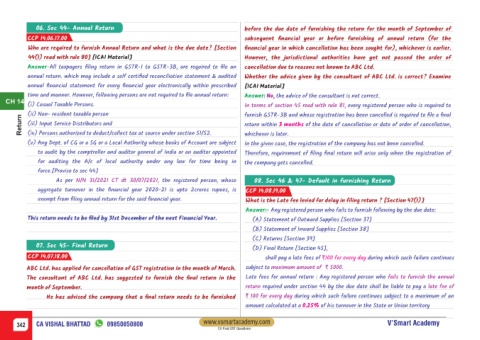

06. Sec 44- Annual Return before the due date of furnishing the return for the month of September of

CCP 14.06.17.00 subsequent financial year or before furnishing of annual return (for the

Who are required to furnish Annual Return and what is the due date? [Section financial year in which cancellation has been sought for), whichever is earlier.

44(1) read with rule 80] [ICAI Material] However, the jurisdictional authorities have yet not passed the order of

Answer-All taxpayers filing return in GSTR-1 to GSTR-3B, are required to file an cancellation due to reasons not known to ABC Ltd.

annual return. which may include a self certified reconciliation statement & audited Whether the advice given by the consultant of ABC Ltd. is correct? Examine

annual financial statement for every financial year electronically within prescribed [ICAI Material]

time and manner. However, following persons are not required to file annual return: Answer: No, the advice of the consultant is not correct.

CH 14

(i) Casual Taxable Persons. In terms of section 45 read with rule 81, every registered person who is required to

(ii) Non- resident taxable person furnish GSTR-3B and whose registration has been cancelled is required to file a final

Return (iii) Input Service Distributors and return within 3 months of the date of cancellation or date of order of cancellation,

(iv) Persons authorized to deduct/collect tax at source under section 51/52.

whichever is later.

(v) Any Dept. of CG or a SG or a Local Authority whose books of Account are subject In the given case, the registration of the company has not been cancelled.

to audit by the comptroller and auditor general of India or an auditor appointed Therefore, requirement of filing final return will arise only when the registration of

for auditing the A/c of local authority under any law for time being in the company gets cancelled.

force.[Proviso to sec 44]

As per N/N 31/2021 CT dt 30/07/2021, the registered person, whose 08. Sec 46 & 47- Default in furnishing Return

aggregate turnover in the financial year 2020-21 is upto 2crores rupees, is CCP 14.08.19.00

exempt from filing annual return for the said financial year. What is the Late fee levied for delay in filing return ? [Section 47(1)]

Answer:- Any registered person who fails to furnish following by the due date:

This return needs to be filed by 31st December of the next Financial Year. (A) Statement of Outward Supplies [Section 37]

(B) Statement of Inward Supplies [Section 38]

(C) Returns [Section 39]

07. Sec 45- Final Return

(D) Final Return [Section 45],

CCP 14.07.18.00 shall pay a late fees of `100 for every day during which such failure continues

ABC Ltd. has applied for cancellation of GST registration in the month of March. subject to maximum amount of ` 5000.

The consultant of ABC Ltd. has suggested to furnish the final return in the Late fees for annual return : Any registered person who fails to furnish the annual

month of September. return required under section 44 by the due date shall be liable to pay a late fee of

He has advised the company that a final return needs to be furnished ` 100 for every day during which such failure continues subject to a maximum of an

amount calculated at a 0.25% of his turnover in the State or Union territory

www.vsmartacademy.com

342 CA VISHAL BHATTAD 09850850800 V’Smart Academy

CA Final GST Questioner