Page 5 - Chapter 14 Return.cdr

P. 5

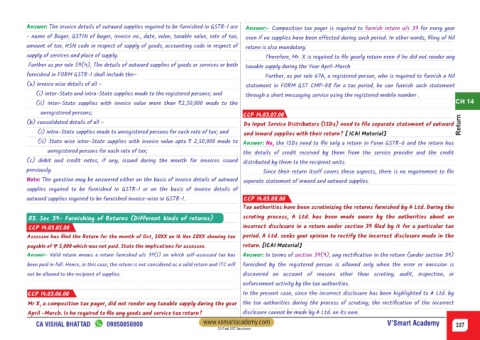

Answer: The invoice details of outward supplies required to be furnished in GSTR-1 are Answer:- Composition tax payer is required to furnish return u/s 39 for every year

- name of Buyer, GSTIN of buyer, invoice no., date, value, taxable value, rate of tax, even if no supplies have been effected during such period. In other words, filing of Nil

amount of tax, HSN code in respect of supply of goods, accounting code in respect of return is also mandatory.

supply of services and place of supply. Therefore, Mr. X is required to file yearly return even if he did not render any

Further as per rule 59(4), The details of outward supplies of goods or services or both taxable supply during the Year April-March

furnished in FORM GSTR-1 shall include the– Further, as per rule 67A, a registered person, who is required to furnish a Nil

(a) invoice wise details of all – statement in FORM GST CMP-08 for a tax period, he can furnish such statement

(i) inter-State and intra-State supplies made to the registered persons; and through a short messaging service using the registered mobile number .

(ii) inter-State supplies with invoice value more than `2,50,000 made to the CH 14

unregistered persons;

CCP 14.03.07.00

(b) consolidated details of all – Do Input Service Distributors (ISDs) need to file separate statement of outward Return

(i) intra-State supplies made to unregistered persons for each rate of tax; and and inward supplies with their return? [ ICAI Material]

(ii) State wise inter-State supplies with invoice value upto ` 2,50,000 made to Answer: No, the ISDs need to file only a return in Form GSTR-6 and the return has

unregistered persons for each rate of tax; the details of credit received by them from the service provider and the credit

(c) debit and credit notes, if any, issued during the month for invoices issued distributed by them to the recipient units.

previously. Since their return itself covers these aspects, there is no requirement to file

Note: The question may be answered either on the basis of invoice details of outward separate statement of inward and outward supplies.

supplies required to be furnished in GSTR-1 or on the basis of invoice details of

outward supplies required to be furnished invoice-wise in GSTR-1. CCP 14.03.08.00

Tax authorities have been scrutinizing the returns furnished by A Ltd. During the

03. Sec 39- Furnishing of Returns (Different kinds of returns) scrutiny process, A Ltd. has been made aware by the authorities about an

CCP 14.03.05.00 incorrect disclosure in a return under section 39 filed by it for a particular tax

Assessee has filed the Return for the month of Oct, 20XX on 16 Nov 20XX showing tax period. A Ltd. seeks your opinion to rectify the incorrect disclosure made in the

payable of ₹ 5,000 which was not paid. State the implications for assessee. return. [ICAI Material]

Answer- Valid return means a return furnished u/s 39(1) on which self-assessed tax has Answer: In terms of section 39(9) , any rectification in the return (under section 39)

been paid in full. Hence, in this case, the return is not considered as a valid return and ITC will furnished by the registered person is allowed only when the error or omission is

not be allowed to the recipient of supplies. discovered on account of reasons other than scrutiny, audit, inspection, or

enforcement activity by the tax authorities.

CCP 14.03.06.00 In the present case, since the incorrect disclosure has been highlighted to A Ltd. by

Mr X, a composition tax payer, did not render any taxable supply during the year the tax authorities during the process of scrutiny, the rectification of the incorrect

April -March. Is he required to file any goods and service tax return? disclosure cannot be made by A Ltd. on its own.

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 337

CA Final GST Questioner