Page 9 - Chapter 14 Return.cdr

P. 9

Similarly, they would be required to file only 4 GSTR-1 returns since

Answer- As per Rule 67A read with N/N 79/2020 -Notwithstanding anything

Invoice Filing Facility (IFF) is provided under this scheme.

contained in this Chapter, for a registered person who is required to furnish

Opting of QRMP scheme is GSTIN wise. Distinct persons can avail

· a Nil return under section 39 in FORM GSTR-3B or

QRMP scheme option for one or more GSTINs. It implies that some GSTINs for a PAN

· a Nil details of outward supplies under section 37 in FORM GSTR-1 or

can opt for the QRMP scheme and remaining GSTINs may not opt for the said

· a Nil statement in FORM GST CMP-08 (quarterly tax payment statement

scheme.

for composition taxpayer)

Since the aggregate turnover of Padmavati Traders does not exceed

for a tax period,

` 5 crores in the preceding financial year, it is eligible for furnishing the return on

any reference to electronic furnishing shall include furnishing of the said

quarterly basis till the time its turnover in the current financial year does not exceed CH 14

return or the details of outward supplies or statement through a short messaging

` 5 crore.

service using the registered mobile number and the said return or the details of

In case its aggregate turnover crosses ` 5 crore during a quarter in the

outward supplies or statement shall be verified by a registered mobile number based Return

current financial year, it shall no longer be eligible for furnishing of return on quarterly

One Time Password facility.

basis from the first month of the succeeding quarter and needs to opt for furnishing

Therefore considering the above provision Mr. X can furnish GSTR-1 or GSTR-3B or

of return on a monthly basis, electronically, on the common portal, from the first

FORM GST CMP-08 under different situation as follows-

month of the quarter, succeeding the quarter during which its aggregate turnover

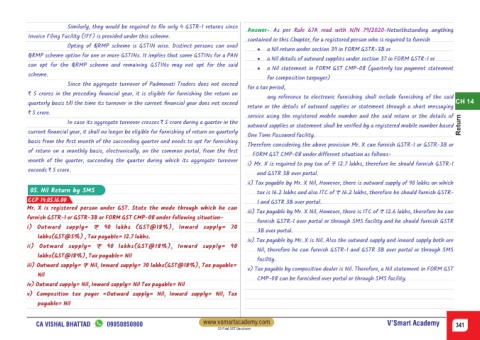

i) Mr. X is required to pay tax of ₹ 12.7 lakhs, therefore he should furnish GSTR-1

exceeds ` 5 crore.

and GSTR 3B over portal.

ii) Tax payable by Mr. X Nil, However, there is outward supply of 90 lakhs on which

05. Nil Return by SMS tax is 16.2 lakhs and also ITC of ₹ 16.2 lakhs, therefore he should furnish GSTR-

CCP 14.05.16.00 1 and GSTR 3B over portal.

Mr. X is registered person under GST. State the mode through which he can

iii) Tax payable by Mr. X Nil, However, there is ITC of ₹ 12.6 lakhs, therefore he can

furnish GSTR-1 or GSTR-3B or FORM GST CMP-08 under following situation-

furnish GSTR-1 over portal or through SMS facility and he should furnish GSTR

i) Outward supply= ₹ 90 lakhs (GST@18%), Inward supply= 70

3B over portal.

lakhs(GST@5%) , Tax payable= 12.7 lakhs.

iv) Tax payable by Mr. X is Nil. Also the outward supply and inward supply both are

ii) Outward supply= ₹ 90 lakhs(GST@18%), Inward supply= 90

Nil, therefore he can furnish GSTR-1 and GSTR 3B over portal or through SMS

lakhs(GST@18%), Tax payable= Nil

facility.

iii) Outward supply= ₹ Nil, Inward supply= 70 lakhs(GST@18%), Tax payable=

v) Tax payable by composition dealer is Nil. Therefore, a Nil statement in FORM GST

Nil

CMP-08 can be furnished over portal or through SMS facility.

iv) Outward supply= Nil, Inward supply= Nil Tax payable= Nil

v) Composition tax payer =Outward supply= Nil, Inward supply= Nil, Tax

payable= Nil

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 341

CA Final GST Questioner