Page 4 - Chapter 14 Return.cdr

P. 4

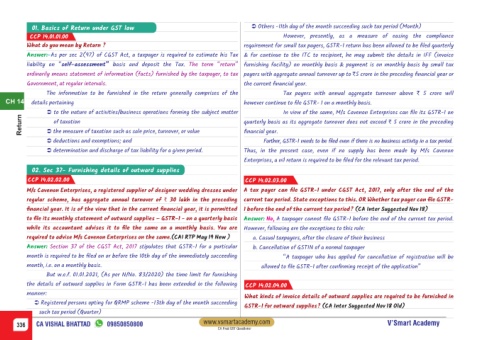

01. Basics of Return under GST law Ü Others -11th day of the month succeeding such tax period (Month)

CCP 14.01.01.00 However, presently, as a measure of easing the compliance

What do you mean by Return ? requirement for small tax payers, GSTR-1 return has been allowed to be filed quarterly

Answer:-As per sec 2(97) of CGST Act, a taxpayer is required to estimate his Tax & for continue to the ITC to recipient, he may submit the details in IFF (invoice

liability on “self-assessment” basis and deposit the Tax. The term “return” furnishing facility) on monthly basis & payment is on monthly basis by small tax

ordinarily means statement of information (facts) furnished by the taxpayer, to tax payers with aggregate annual turnover up to `5 crore in the preceding financial year or

Government, at regular intervals. the current financial year.

The information to be furnished in the return generally comprises of the Tax payers with annual aggregate turnover above ` 5 crore will

CH 14 details pertaining however continue to file GSTR- 1 on a monthly basis.

Ü to the nature of activities/business operations forming the subject matter In view of the same, M/s Cavenon Enterprises can file its GSTR-1 on

Return Ü the measure of taxation such as sale price, turnover, or value quarterly basis as its aggregate turnover does not exceed ` 5 crore in the preceding

of taxation

financial year.

Ü deductions and exemptions; and Further, GSTR-1 needs to be filed even if there is no business activity in a tax period.

Ü determination and discharge of tax liability for a given period. Thus, in the present case, even if no supply has been made by M/s Cavenon

Enterprises, a nil return is required to be filed for the relevant tax period.

02. Sec 37- Furnishing details of outward supplies

CCP 14.02.02.00 CCP 14.02.03.00

M/s Cavenon Enterprises, a registered supplier of designer wedding dresses under A tax payer can file GSTR-1 under CGST Act, 2017, only after the end of the

regular scheme, has aggregate annual turnover of ` 30 lakh in the preceding current tax period. State exceptions to this. OR Whether tax payer can file GSTR-

financial year. It is of the view that in the current financial year, it is permitted 1 before the end of the current tax period? (CA Inter Suggested Nov 18)

to file its monthly statement of outward supplies – GSTR-1 - on a quarterly basis Answer: No, A taxpayer cannot file GSTR-1 before the end of the current tax period.

while its accountant advises it to file the same on a monthly basis. You are However, following are the exceptions to this rule:

required to advise M/s Cavenon Enterprises on the same.(CAI RTP May 19 New ) a. Casual taxpayers, after the closure of their business

Answer: Section 37 of the CGST Act, 2017 stipulates that GSTR-1 for a particular b. Cancellation of GSTIN of a normal taxpayer

month is required to be filed on or before the 10th day of the immediately succeeding “A taxpayer who has applied for cancellation of registration will be

month, i.e. on a monthly basis. allowed to file GSTR-1 after confirming receipt of the application”

But w.e.f. 01.01.2021, (As per N/No. 83/2020) the time limit for furnishing

the details of outward supplies in Form GSTR-1 has been extended in the following CCP 14.02.04.00

manner:

What kinds of invoice details of outward supplies are required to be furnished in

Ü Registered persons opting for QRMP scheme -13th day of the month succeeding

GSTR-1 for outward supplies? (CA Inter Suggested Nov 18 Old)

such tax period (Quarter)

www.vsmartacademy.com

336 CA VISHAL BHATTAD 09850850800 V’Smart Academy

CA Final GST Questioner