Page 11 - 1. COMPILER QB - INDAS 1

P. 11

individual qualification of set of standards on such companies.

In the given case it has been mentioned that the financials of Iktara Ltd. are prepared as per Ind AS.

Accordingly, the results of its subsidiary Softbharti Pvt. Ltd. should also have been prepared as per Ind AS.

However, the financials of Softbharti Pvt. Ltd. Have been presented as per accounting standards (AS).

Hence, it is necessary to revise the financial statements of Softbharti Pvt. Ltd. as per Ind AS after the

incorporation of necessary adjustments mentioned in the question.

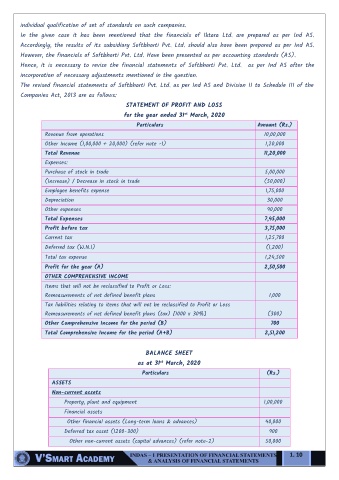

The revised financial statements of Softbharti Pvt. Ltd. as per Ind AS and Division II to Schedule III of the

Companies Act, 2013 are as follows:

STATEMENT OF PROFIT AND LOSS

st

for the year ended 31 March, 2020

Particulars Amount (Rs.)

Revenue from operations 10,00,000

Other Income (1,00,000 + 20,000) (refer note -1) 1,20,000

Total Revenue 11,20,000

Expenses:

Purchase of stock in trade 5,00,000

(Increase) / Decrease in stock in trade (50,000)

Employee benefits expense 1,75,000

Depreciation 30,000

Other expenses 90,000

Total Expenses 7,45,000

Profit before tax 3,75,000

Current tax 1,25,700

Deferred tax (W.N.1) (1,200)

Total tax expense 1,24,500

Profit for the year (A) 2,50,500

OTHER COMPREHENSIVE INCOME

Items that will not be reclassified to Profit or Loss:

Remeasurements of net defined benefit plans 1,000

Tax liabilities relating to items that will not be reclassified to Profit or Loss

Remeasurements of net defined benefit plans (tax) [1000 x 30%] (300)

Other Comprehensive Income for the period (B) 700

Total Comprehensive Income for the period (A+B) 2,51,200

BALANCE SHEET

st

as at 31 March, 2020

Particulars (Rs.)

ASSETS

Non-current assets

Property, plant and equipment 1,00,000

Financial assets

Other financial assets (Long-term loans & advances) 40,000

Deferred tax asset (1200-300) 900

Other non-current assets (capital advances) (refer note-2) 50,000

1. 10