Page 67 - CA Final PARAM Digital Book.

P. 67

In such circumstances, statutory auditor needs to perform procedures directly like comparing net realizable

value of products with costs to verify completeness of provisions, recomputing of provisions for obsolete

stocks etc.

Therefore, in the given situation, he should perform procedures directly in accordance with SA 610.

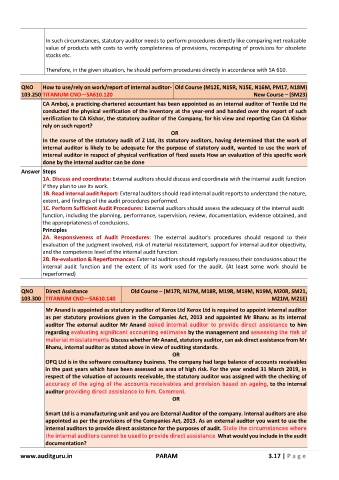

QNO How to use/rely on work/report of internal auditor- Old Course (M12E, N15R, N15E, N16M, PM17, N18M)

103.250 TITANIUM CNO—SA610.120 New Course – (SM23)

CA Amboj, a practicing-chartered accountant has been appointed as an internal auditor of Textile Ltd He

conducted the physical verification of the inventory at the year-end and handed over the report of such

verification to CA Kishor, the statutory auditor of the Company, for his view and reporting Can CA Kishor

rely on such report?

OR

In the course of the statutory audit of Z Ltd, its statutory auditors, having determined that the work of

internal auditor is likely to be adequate for the purpose of statutory audit, wanted to use the work of

internal auditor in respect of physical verification of fixed assets How an evaluation of this specific work

done by the internal auditor can be done

Answer Steps

1A. Discuss and coordinate: External auditors should discuss and coordinate with the internal audit function

if they plan to use its work.

1B. Read internal audit Report: External auditors should read internal audit reports to understand the nature,

extent, and findings of the audit procedures performed.

1C. Perform Sufficient Audit Procedures: External auditors should assess the adequacy of the internal audit

function, including the planning, performance, supervision, review, documentation, evidence obtained, and

the appropriateness of conclusions.

Principles

2A. Responsiveness of Audit Procedures: The external auditor's procedures should respond to their

evaluation of the judgment involved, risk of material misstatement, support for internal auditor objectivity,

and the competence level of the internal audit function.

2B. Re-evaluation & Reperformances: External auditors should regularly reassess their conclusions about the

internal audit function and the extent of its work used for the audit. (At least some work should be

reperformed)

QNO Direct Assistance Old Course – (M17R, N17M, M18R, M19R, M19M, N19M, M20R, SM21,

103.300 TITANIUM CNO—SA610.140 M21M, M21E)

Mr Anand is appointed as statutory auditor of Xerox Ltd Xerox Ltd is required to appoint internal auditor

as per statutory provisions given in the Companies Act, 2013 and appointed Mr Bhanu as its internal

auditor The external auditor Mr Anand asked internal auditor to provide direct assistance to him

regarding evaluating significant accounting estimates by the management and assessing the risk of

material misstatements Discuss whether Mr Anand, statutory auditor, can ask direct assistance from Mr

Bhanu, internal auditor as stated above in view of auditing standards.

OR

OPQ Ltd is in the software consultancy business. The company had large balance of accounts receivables

in the past years which have been assessed as area of high risk. For the year ended 31 March 2019, in

respect of the valuation of accounts receivable, the statutory auditor was assigned with the checking of

accuracy of the aging of the accounts receivables and provision based on ageing, to the internal

auditor providing direct assistance to him. Comment.

OR

Smart Ltd is a manufacturing unit and you are External Auditor of the company. Internal auditors are also

appointed as per the provisions of the Companies Act, 2013. As an external auditor you want to use the

internal auditors to provide direct assistance for the purposes of audit. State the circumstances where

the internal auditors cannot be used to provide direct assistance. What would you include in the audit

documentation?

www.auditguru.in PARAM 3.17 | P a g e