Page 16 - Chap7 ITC

P. 16

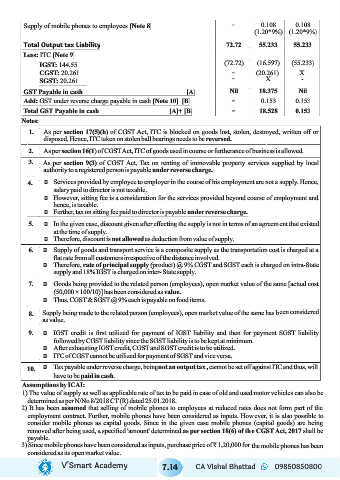

Supply of mobile phones to employees [Note 8] - 0.108 0.108

(1.20*9%) (1.20*9%)

Total Output tax Liability 72.72 55.233 55.233

Less: ITC [Note 9]

IGST: 144.55 (72.72) (16.597) (55.233)

CGST: 20.261 - (20.261) X

SGST: 20.261 - X -

GST Payable in cash [A] Nil 18.375 Nil

Add: GST under reverse charge payable in cash [Note 10] [B] - 0.153 0.153

Total GST Payable in cash [A]+ [B] - 18.528 0.153

Notes:

1. As per section 17(5)(h) of CGST Act, ITC is blocked on goods lost, stolen, destroyed, written off or

disposed, Hence, ITC taken on stolen ball bearings needs to be reversed.

2. As per section 16(1) of CGST Act, ITC of goods used in course or furtherance of business is allowed.

3. As per section 9(3) of CGST Act, Tax on renting of immovable property services supplied by local

authority to a registered person is payable under reverse charge.

4. Ü Services provided by employee to employer in the course of his employment are not a supply. Hence,

salary paid to director is not taxable.

Ü However, sitting fee is a consideration for the services provided beyond course of employment and

hence, is taxable.

Ü Further, tax on sitting fee paid to director is payable under reverse charge.

5. Ü In the given case, discount given after effecting the supply is not in terms of an agreement that existed

at the time of supply.

Ü Therefore, discount is not allowed as deduction from value of supply.

6. Ü Supply of goods and transport service is a composite supply as the transportation cost is charged at a

flat rate from all customers irrespective of the distance involved.

Ü Therefore, rate of principal supply (product) @ 9% CGST and SGST each is charged on intra-State

supply and 18% IGST is charged on inter- State supply.

7. Ü Goods being provided to the related person (employees), open market value of the same [actual cost

(50,000 × 100/10)] has been considered as value.

Ü Thus, CGST & SGST @ 9% each is payable on food items.

8. Supply being made to the related person (employees), open market value of the same has been considered

as value.

9. Ü IGST credit is first utilized for payment of IGST liability and then for payment SGST liability

followed by CGST liability since the SGST liability is to be kept at minimum.

Ü After exhausting IGST credit, CGST and SGST credit is to be utilized.

Ü ITC of CGST cannot be utilized for payment of SGST and vice versa.

10. Ü Tax payable under reverse charge, being not an output tax , cannot be set off against ITC and thus, will

have to be paid in cash.

Assumptions by ICAI:

1) The value of supply as well as applicable rate of tax to be paid in case of old and used motor vehicles can also be

determined as per N/No 8/2018 CT (R) dated 25.01.2018.

2) It has been assumed that selling of mobile phones to employees at reduced rates does not form part of the

employment contract. Further, mobile phones have been considered as inputs. However, it is also possible to

consider mobile phones as capital goods. Since in the given case mobile phones (capital goods) are being

removed after being used, a specified 'amount' determined as per section 18(6) of the CGST Act, 2017 shall be

payable.

3) Since mobile phones have been considered as inputs, purchase price of ₹ 1,20,000 for the mobile phones has been

considered as its open market value.

V’Smart Academy 7.14 CA Vishal Bhattad 09850850800