Page 4 - Chapter 10 Registration

P. 4

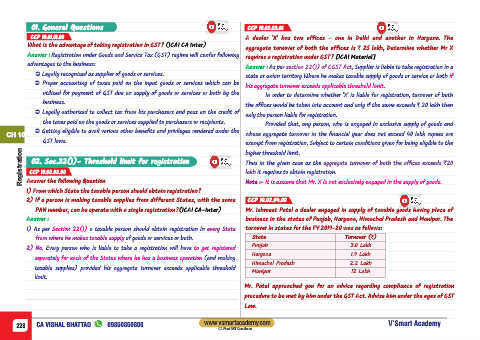

01. General Questions CCP 10.02.03.00

CCP 10.01.01.00 A dealer 'X' has two offices – one in Delhi and another in Haryana. The

What is the advantage of taking registration in GST? (ICAI CA Inter) aggregate turnover of both the offices is ` 25 lakh, Determine whether Mr X

Answer : Registration under Goods and Service Tax (GST) regime will confer following requires a registration under GST? [ICAI Material]

advantages to the business: Answer : As per section 22(1) of CGST Act, Supplier is liable to take registration in a

Ü Legally recognized as supplier of goods or services. state or union territory Where he makes taxable supply of goods or service or both if

Ü Proper accounting of taxes paid on the input goods or services which can be his aggregate turnover exceeds applicable threshold limit.

utilized for payment of GST due on supply of goods or services or both by the In order to determine whether 'X' is liable for registration, turnover of both

business. the offices would be taken into account and only if the same exceeds ` 20 lakh then

Ü Legally authorized to collect tax from his purchasers and pass on the credit of only the person liable for registration.

the taxes paid on the goods or services supplied to purchasers or recipients.

Provided that, any person, who is engaged in exclusive supply of goods and

Ü Getting eligible to avail various other benefits and privileges rendered under the

CH 10 whose aggregate turnover in the financial year does not exceed 40 lakh rupees are

GST laws.

exempt from registration. Subject to certain conditions given for being eligible to the

Registration CCP 10.02.02.00 Thus in the given case as the aggregate turnover of both the offices exceeds `20

higher threshold limit.

02. Sec.22(1)- Threshold limit for registration

lakh it requires to obtain registration.

Answer the following Question

1) From which State the taxable person should obtain registration? Note :- It is assume that Mr. X is not exclusively engaged in the supply of goods.

2) If a person is making taxable supplies from different States, with the same CCP 10.02.04.00

PAN number, can he operate with a single registration?(ICAI CA-Inter) Mr. Ishmeet Patel a dealer engaged in supply of taxable goods having place of

Answer : business in the states of Punjab, Haryana, Himachal Pradesh and Manipur. The

1) As per Section 22(1) a taxable person should obtain registration in every State turnover in states for the FY 2019-20 was as follows:

from where he makes taxable supply of goods or services or both. State Turnover (`)

Punjab 3.0 Lakh

2) No. Every person who is liable to take a registration will have to get registered

Haryana 1.9 Lakh

separately for each of the States where he has a business operation (and making

Himachal Pradesh 2.2 Lakh

taxable supplies) provided his aggregate turnover exceeds applicable threshold

Manipur 12 Lakh

limit.

Mr. Patel approached you for an advice regarding compliance of registration

procedure to be met by him under the GST Act. Advise him under the eyes of GST

Law.

www.vsmartacademy.com

228 CA VISHAL BHATTAD 09850850800 V’Smart Academy

CA Final GST Questioner