Page 26 - 16. COMPILER QB - INDAS 103

P. 26

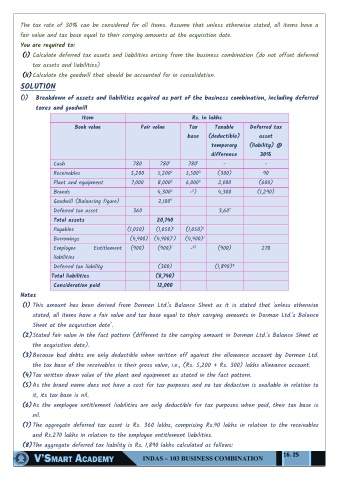

The tax rate of 30% can be considered for all items. Assume that unless otherwise stated, all items have a

fair value and tax base equal to their carrying amounts at the acquisition date.

You are required to:

(i) Calculate deferred tax assets and liabilities arising from the business combination (do not offset deferred

tax assets and liabilities)

(ii) Calculate the goodwill that should be accounted for in consolidation.

SOLUTION

(i) Breakdown of assets and liabilities acquired as part of the business combination, including deferred

taxes and goodwill

Item Rs. In lakhs

Book value Fair value Tax Taxable Deferred tax

base (deductible) asset

temporary (liability) @

difference 30%

1

Cash 780 780 1 780 - -

2

3

Receivables 5,200 5,200 5,500 (300) 90

4

2

Plant and equipment 7,000 8,000 6,000 2,000 (600)

5

2

Brands 4,300 - ) 4,300 (1,290)

9

Goodwill (Balancing figure) 2,100

Deferred tax asset 360 3,60 7

Total assets 20,740

Payables (1,050) (1,050) 1 (1,050) 1

1

Borrowings (4,900) (4,900) ) (4,900) 1

Employee Entitlement (900) (900) 1 - 6) (900) 270

liabilities

Deferred tax liability (300) (1,890) 8

Total liabilities (8,740)

Consideration paid 12,000

Notes

(1) This amount has been derived from Dorman Ltd.'s Balance Sheet as it is stated that 'unless otherwise

stated, all items have a fair value and tax base equal to their carrying amounts in Dorman Ltd.'s Balance

Sheet at the acquisition date‖.

(2) Stated fair value in the fact pattern (different to the carrying amount in Dorman Ltd.'s Balance Sheet at

the acquisition date).

(3) Because bad debts are only deductible when written off against the allowance account by Dorman Ltd.

the tax base of the receivables is their gross value, i.e., (Rs. 5,200 + Rs. 300) lakhs allowance account.

(4) Tax written down value of the plant and equipment as stated in the fact pattern.

(5) As the brand name does not have a cost for tax purposes and no tax deduction is available in relation to

it, its tax base is nil.

(6) As the employee entitlement liabilities are only deductible for tax purposes when paid, their tax base is

nil.

(7) The aggregate deferred tax asset is Rs. 360 lakhs, comprising Rs.90 lakhs in relation to the receivables

and Rs.270 lakhs in relation to the employee entitlement liabilities.

(8) The aggregate deferred tax liability is Rs. 1,890 lakhs calculated as follows:

16. 25