Page 13 - 27. COMPILER QB - IND AS 7

P. 13

MTPs QUESTIONS

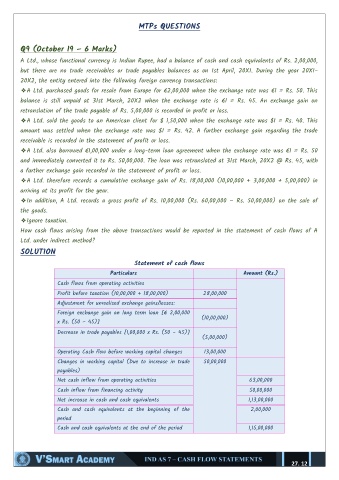

Q9 (October 19 – 6 Marks)

A Ltd., whose functional currency is Indian Rupee, had a balance of cash and cash equivalents of Rs. 2,00,000,

but there are no trade receivables or trade payables balances as on 1st April, 20X1. During the year 20X1-

20X2, the entity entered into the following foreign currency transactions:

❖A Ltd. purchased goods for resale from Europe for €2,00,000 when the exchange rate was €1 = Rs. 50. This

balance is still unpaid at 31st March, 20X2 when the exchange rate is €1 = Rs. 45. An exchange gain on

retranslation of the trade payable of Rs. 5,00,000 is recorded in profit or loss.

❖A Ltd. sold the goods to an American client for $ 1,50,000 when the exchange rate was $1 = Rs. 40. This

amount was settled when the exchange rate was $1 = Rs. 42. A further exchange gain regarding the trade

receivable is recorded in the statement of profit or loss.

❖A Ltd. also borrowed €1,00,000 under a long-term loan agreement when the exchange rate was €1 = Rs. 50

and immediately converted it to Rs. 50,00,000. The loan was retranslated at 31st March, 20X2 @ Rs. 45, with

a further exchange gain recorded in the statement of profit or loss.

❖A Ltd. therefore records a cumulative exchange gain of Rs. 18,00,000 (10,00,000 + 3,00,000 + 5,00,000) in

arriving at its profit for the year.

❖In addition, A Ltd. records a gross profit of Rs. 10,00,000 (Rs. 60,00,000 – Rs. 50,00,000) on the sale of

the goods.

❖Ignore taxation.

How cash flows arising from the above transactions would be reported in the statement of cash flows of A

Ltd. under indirect method?

SOLUTION

Statement of cash flows

Particulars Amount (Rs.)

Cash flows from operating activities

Profit before taxation (10,00,000 + 18,00,000) 28,00,000

Adjustment for unrealised exchange gains/losses:

Foreign exchange gain on long term loan [€ 2,00,000

(10,00,000)

x Rs. (50 – 45)]

Decrease in trade payables [1,00,000 x Rs. (50 – 45)]

(5,00,000)

Operating Cash flow before working capital changes 13,00,000

Changes in working capital (Due to increase in trade 50,00,000

payables)

Net cash inflow from operating activities 63,00,000

Cash inflow from financing activity 50,00,000

Net increase in cash and cash equivalents 1,13,00,000

Cash and cash equivalents at the beginning of the 2,00,000

period

Cash and cash equivalents at the end of the period 1,15,00,000

27. 12