Page 11 - 32. ANALYSIS OF FS

P. 11

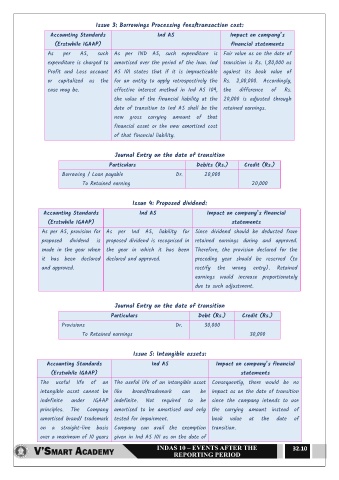

Issue 3: Borrowings Processing fees/transaction cost:

Accounting Standards Ind AS Impact on company’s

(Erstwhile IGAAP) financial statements

As per AS, such As per IND AS, such expenditure is Fair value as on the date of

expenditure is charged to amortised over the period of the loan. Ind transition is Rs. 1,80,000 as

Profit and Loss account AS 101 states that if it is impracticable against its book value of

or capitalized as the for an entity to apply retrospectively the Rs. 2,00,000. Accordingly,

case may be. effective interest method in Ind AS 109, the difference of Rs.

the value of the financial liability at the 20,000 is adjusted through

date of transition to Ind AS shall be the retained earnings.

new gross carrying amount of that

financial asset or the new amortised cost

of that financial liability.

Journal Entry on the date of transition

Particulars Debits (Rs.) Credit (Rs.)

Borrowing / Loan payable Dr. 20,000

To Retained earning 20,000

Issue 4: Proposed dividend:

Accounting Standards Ind AS Impact on company’s financial

(Erstwhile IGAAP) statements

As per AS, provision for As per Ind AS, liability for Since dividend should be deducted from

proposed dividend is proposed dividend is recognised in retained earnings during and approved.

made in the year when the year in which it has been Therefore, the provision declared for the

it has been declared declared and approved. preceding year should be reserved (to

and approved. rectify the wrong entry). Retained

earnings would increase proportionately

due to such adjustment.

Journal Entry on the date of transition

Particulars Debt (Rs.) Credit (Rs.)

Provisions Dr. 30,000

To Retained earnings 30,000

Issue 5: Intangible assets:

Accounting Standards Ind AS Impact on company’s financial

(Erstwhile IGAAP) statements

The useful life of an The useful life of an intangible asset Consequently, there would be no

intangible asset cannot be like brand/trademark can be impact as on the date of transition

indefinite under IGAAP indefinite. Not required to be since the company intends to use

principles. The Company amortised to be amortised and only the carrying amount instead of

amortised brand/ trademark tested for impairment. book value at the date of

on a straight-line basis Company can avail the exemption transition.

over a maximum of 10 years given in Ind AS 101 as on the date of

32.10