Page 15 - Chapter 10 Registration

P. 15

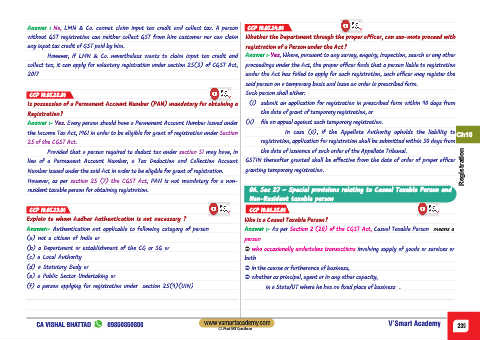

Answer : No, LMN & Co. cannot claim input tax credit and collect tax. A person CCP 10.05.24.00

without GST registration can neither collect GST from him customer nor can claim Whether the Department through the proper officer, can suo-moto proceed with

any input tax credit of GST paid by him. registration of a Person under the Act?

However, if LMN & Co. nevertheless wants to claim input tax credit and Answer :-Yes, Where, pursuant to any survey, enquiry, inspection, search or any other

collect tax, it can apply for voluntary registration under section 25(3) of CGST Act, proceedings under the Act, the proper officer finds that a person liable to registration

2017 under the Act has failed to apply for such registration, such officer may register the

said person on a temporary basis and issue an order in prescribed form.

CCP 10.05.22.00 Such person shall either:

Is possession of a Permanent Account Number (PAN) mandatory for obtaining a (i) submit an application for registration in prescribed form within 90 days from

Registration? the date of grant of temporary registration, or

Answer :- Yes. Every person should have a Permanent Account Number issued under (ii) file an appeal against such temporary registration.

the Income Tax Act, 1961 in order to be eligible for grant of registration under Section In case (ii), if the Appellate Authority upholds the liability to Ch10

25 of the CGST Act. registration, application for registration shall be submitted within 30 days from

Provided that a person required to deduct tax under section 51 may have, in the date of issuance of such order of the Appellate Tribunal.

lieu of a Permanent Account Number, a Tax Deduction and Collection Account GSTIN thereafter granted shall be effective from the date of order of proper officer

Number issued under the said Act in order to be eligible for grant of registration. granting temporary registration. Registration

However, as per section 25 (7) the CGST Act, PAN is not mandatory for a non-

resident taxable person for obtaining registration. 06. Sec 27 – Special provisions relating to Casual Taxable Person and

Non-Resident taxable person

CCP 10.05.23.00 CCP 10.06.25.00

Explain to whom Aadhar Authentication is not necessary ? Who is a Casual Taxable Person?

Answer:- Authentication not applicable to following category of person Answer :- As per Section 2 (20) of the CGST Act, Casual Taxable Person means a

(a) not a citizen of India or person

(b) a Department or establishment of the CG or SG or Ü who occasionally undertakes transactions involving supply of goods or services or

(c) a Local Authority both

(d) a Statutory Body or Ü in the course or furtherance of business,

(e) a Public Sector Undertaking or Ü whether as principal, agent or in any other capacity,

(f) a person applying for registration under section 25(9)(UIN) in a State/UT where he has no fixed place of business .

CA VISHAL BHATTAD 09850850800 www.vsmartacademy.com V’Smart Academy 239

CA Final GST Questioner