Page 26 - Chapter 2.cdr

P. 26

Consequently, being an inter-State supply of service, service of hiring out the CCP 02.21.59.00

Power Engineering Pvt. Ltd., a registered supplier, is engaged in providing expert

generators to Morarji Banquet Halls of Chandigarh is subject to IGST @ 18%

CH 2 maintenance and repair services for large power plants that are in the nature of

each.

3. As per section 7(1)(c) of the CGST Act, 2017, an activity made without immovable property, situated all over India. The company has its Head Office at

Charge of Tax & Concept of Supply

consideration can be treated as supply only when it is specified in Schedule I of Bangalore, Karnataka and branch offices in other States. The work is done in the

the CGST Act, 2017. Para 2. of Schedule I provides that supply of goods or following manner.

The company has self-contained mobile workshops, which are container trucks

services or both between related persons or between distinct persons as specified

in section 25, when made in the course or furtherance of business, are to be fitted out for carrying out the repairs. The trucks are equipped with items like

repair equipments, consumables, tools, parts etc. to handle a wide variety of

treated as supply even if made without consideration.

However, since the question does not provide that customers repair work.

are related to Jaskaran, free gifts given to the customers cannot be considered as The truck is sent to the client location for carrying out the repair work.

Depending upon the repairs to be done, the equipment, consumables, tools,

a supply under section 7. Consequently, no tax is leviable on the same.

Further, the catering services provided by Jaskaran to his parts etc. are used from the stock of such items carried in the truck.

elder son's without consideration will be treated as supply as Jaskaran and his In some cases, a stand-alone machine is also sent to the client's premises in

elder son's , being members of same family, are related persons in terms of such truck for carrying out the repair work.

explanation (a)(viii) to section 15 of the CGST Act, 2017 and said services have The customer is billed after the completion of the repair work depending upon

been provided in course/furtherance of business. Value of supply of services the nature of the work and the actual quantity of consumables, parts etc. used

between related persons, other than through an agent is determined as per rule in the repair work.

28 of the CGST Rules, 2017. Accordingly, the value of supply is the open market Sometimes the truck is sent to the company's own location in other State(s)

value of such supply; if open market value is not available, the value of supply of from where it is further sent to client locations for repairs.

goods or services of like kind and quality. However, if value cannot be determined Work out the GST liability [CGST & SGST or IGST, as the case may be] of

under said methods, it must be worked out based on the cost of the supply plus Power Engineering Pvt. Ltd., Bangalore on the basis of the facts as

10% mark -up. Thus, in the given case, value of catering services provided to the described, read with the following data for the month of November 20XX.

elder son's of Jaskaran is ` 60,500 [` 55,000 × 110%]. Further, being an intra-

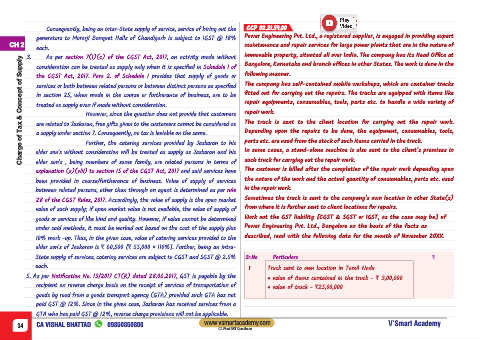

State supply of services, catering services are subject to CGST and SGST @ 2.5% Sr.No Particulars `

each. 1 Truck sent to own location in Tamil Nadu

5. As per Notification No. 13/2017 CT(R) dated 28.06.2017 , GST is payable by the · value of items contained in the truck - ` 3,00,000

recipient on reverse charge basis on the receipt of services of transportation of · value of truck - `25,00,000

goods by road from a goods transport agency (GTA) provided such GTA has not

paid GST @ 12%. Since in the given case, Jaskaran has received services from a

GTA who has paid GST @ 12%, reverse charge provisions will not be applicable.

www.vsmartacademy.com

34 CA VISHAL BHATTAD 09850850800 V’Smart Academy

CA Final GST Questioner