Page 10 - 2. COMPILER QB - INDAS 12

P. 10

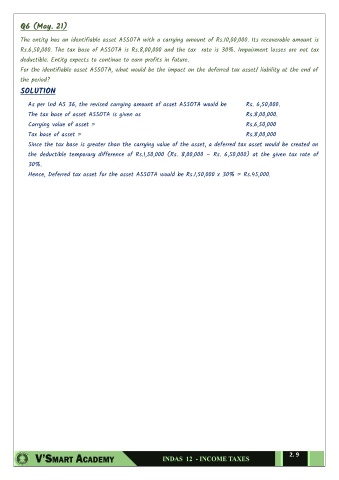

Q6 (May. 21)

The entity has an identifiable asset ASSOTA with a carrying amount of Rs.10,00,000. Its recoverable amount is

Rs.6,50,000. The tax base of ASSOTA is Rs.8,00,000 and the tax rate is 30%. Impairment losses are not tax

deductible. Entity expects to continue to earn profits in future.

For the identifiable asset ASSOTA, what would be the impact on the deferred tax asset/ liability at the end of

the period?

SOLUTION

As per Ind AS 36, the revised carrying amount of asset ASSOTA would be Rs. 6,50,000.

The tax base of asset ASSOTA is given as Rs.8,00,000.

Carrying value of asset = Rs.6,50,000

Tax base of asset = Rs.8,00,000

Since the tax base is greater than the carrying value of the asset, a deferred tax asset would be created on

the deductible temporary difference of Rs.1,50,000 (Rs. 8,00,000 – Rs. 6,50,000) at the given tax rate of

30%.

Hence, Deferred tax asset for the asset ASSOTA would be Rs.1,50,000 x 30% = Rs.45,000.

2. 9