Page 21 - 30. COMPILER QB - IND AS 101

P. 21

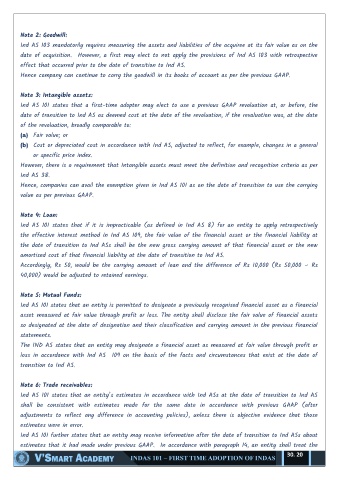

Note 2: Goodwill:

Ind AS 103 mandatorily requires measuring the assets and liabilities of the acquiree at its fair value as on the

date of acquisition. However, a first may elect to not apply the provisions of Ind AS 103 with retrospective

effect that occurred prior to the date of transition to Ind AS.

Hence company can continue to carry the goodwill in its books of account as per the previous GAAP.

Note 3: Intangible assets:

Ind AS 101 states that a first-time adopter may elect to use a previous GAAP revaluation at, or before, the

date of transition to Ind AS as deemed cost at the date of the revaluation, if the revaluation was, at the date

of the revaluation, broadly comparable to:

(a) Fair value; or

(b) Cost or depreciated cost in accordance with Ind AS, adjusted to reflect, for example, changes in a general

or specific price index.

However, there is a requirement that Intangible assets must meet the definition and recognition criteria as per

Ind AS 38.

Hence, companies can avail the exemption given in Ind AS 101 as on the date of transition to use the carrying

value as per previous GAAP.

Note 4: Loan:

Ind AS 101 states that if it is impracticable (as defined in Ind AS 8) for an entity to apply retrospectively

the effective interest method in Ind AS 109, the fair value of the financial asset or the financial liability at

the date of transition to Ind ASs shall be the new gross carrying amount of that financial asset or the new

amortised cost of that financial liability at the date of transition to Ind AS.

Accordingly, Rs 50, would be the carrying amount of loan and the difference of Rs 10,000 (Rs 50,000 – Rs

40,000) would be adjusted to retained earnings.

Note 5: Mutual Funds:

Ind AS 101 states that an entity is permitted to designate a previously recognised financial asset as a financial

asset measured at fair value through profit or loss. The entity shall disclose the fair value of financial assets

so designated at the date of designation and their classification and carrying amount in the previous financial

statements.

The IND AS states that an entity may designate a financial asset as measured at fair value through profit or

loss in accordance with Ind AS 109 on the basis of the facts and circumstances that exist at the date of

transition to Ind AS.

Note 6: Trade receivables:

Ind AS 101 states that an entity’s estimates in accordance with Ind ASs at the date of transition to Ind AS

shall be consistent with estimates made for the same date in accordance with previous GAAP (after

adjustments to reflect any difference in accounting policies), unless there is objective evidence that those

estimates were in error.

Ind AS 101 further states that an entity may receive information after the date of transition to Ind ASs about

estimates that it had made under previous GAAP. In accordance with paragraph 14, an entity shall treat the

30. 20