Page 30 - Chap7 ITC

P. 30

banking company or a financial institution including a non-banking financial company,

engaged in supplying services by way of accepting deposits, extending loans or

advances.

Ü Thus, Value of Exempt Supply:

= 6,00,000 (RCM) + 1,25,00,000 [2,50,000/2*100 (Sale of Building)] + 2,50,000 [1% of

2,50,00,000 (Sale of shares)

= 1,33,50,000

Ü Total Turnover:

= ₹ 14,00,000 + ₹ 6,00,000 + ₹ 10,00,000 + ₹ 2,50,000 + ₹ 10,00,000 + ₹ 20,00,000 + ₹

1,25,00,000 + ₹ 4,00,000 + ₹ 2,50,000

= ₹ 1,94,00,000

3) As per section 9(3) of CGST Act, 2017, if legal services are provided by an individual advocate including a

senior advocate to any business entity located in the taxable territory, then the GST is payable on reverse

charge basis by recipient. Further, such services are not eligible for exemption provided as the turnover of the

business entity (Surana & Sons) in the PFY exceeds ₹ 20 lakh.

4) As per section 49(4) amount available in the electronic credit ledger may be used for making payment towards

output tax. However, tax payable under reverse charge is not an output tax. Therefore, input tax credit cannot

be used to pay tax payable under reverse charge and thus, tax payable under reverse charge will have to be paid in

cash.

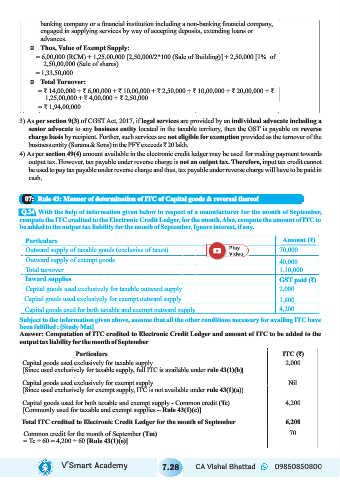

07: Rule 43: Manner of determination of ITC of Capital goods & reversal thereof

Q.24 With the help of information given below in respect of a manufacturer for the month of September,

compute the ITC credited to the Electronic Credit Ledger, for the month. Also, compute the amount of ITC to

be added to the output tax liability for the month of September. Ignore interest, if any.

Particulars Amount (₹)

Outward supply of taxable goods (exclusive of taxes) 70,000

Outward supply of exempt goods

40,000

Total turnover 1,10,000

Inward supplies GST paid (₹)

Capital goods used exclusively for taxable outward supply 2,000

Capital goods used exclusively for exempt outward supply 1,800

Capital goods used for both taxable and exempt outward supply 4,200

Subject to the information given above, assume that all the other conditions necessary for availing ITC have

been fulfilled : [Study Mat]

Answer: Computation of ITC credited to Electronic Credit Ledger and amount of ITC to be added to the

output tax liability for the month of September

Particulars ITC (₹)

Capital goods used exclusively for taxable supply 2,000

[Since used exclusively for taxable supply, full ITC is available under rule 43(1)(b)]

Capital goods used exclusively for exempt supply Nil

[Since used exclusively for exempt supply, ITC is not available under rule 43(1)(a)]

Capital goods used for both taxable and exempt supply - Common credit (Tc) 4,200

[Commonly used for taxable and exempt supplies – Rule 43(1)(c)]

Total ITC credited to Electronic Credit Ledger for the month of September 6,200

Common credit for the month of September (Tm) 70

= Tc ÷ 60 = 4,200 ÷ 60 [Rule 43(1)(e)]

V’Smart Academy 7.28 CA Vishal Bhattad 09850850800